Chapter 1.

Introduction to Partnership and

Partnership Final Account

A. Select the most appropriate alternative from the following & rewrite the sentence.

1.

When

there is no partnership agreement between partners, the division of profits

takes place in __________ ratio.

a) Equal

b)

Capital

Ratio

c)

Initial

Contribution

d)

Experience

and tenure of partner

2.

To find out Net profit or Net Loss of the

business __________ account is prepared.

a) Trading

b) Capital

c) Current

d)

Profit & Loss

3. A __________ is an Intangible Asset.

a)

Goodwill

b)

Stock

c)

Cash

d)

Furniture

4. In the absence of an agreement, interest on loan

advance by the partner to the firm is allowed at the rate of __________.

a)

5%

b)

6%

c)

10%

d)

9%

5. Liability of partners in a partnership business is

__________.

a)

Limited

b)

Unlimited

c)

Limited

and Unlimited

d)

No

of the above

6. The Indian Partnership Act in force since __________.

a)

1932

b)

1881

c)

1956

d)

1984

7. Maximum number of Partners in a firm are __________

according to Company Act 2013.

a)

10

b)

25

c)

20

d)

50

B.

Write

the word/phrase/term, which can substitute the following sentence.

1.

Persons

who form the partnership firm. (Partners)

2.

Amount

of cash or goods withdrawn by partners from the business from time to time. (Drawing)

3.

An

association of two or more persons according to the Indian Partnership Act

1932. (Partnership Firm)

4.

Act

under which partnership firms are regulated. (Indian

partnership Act)

5.

Process

of entering the name of a partnership firm in the register of Registrar. (Registration)

6.

Partnership

agreement in the written form. (Partnership Deed)

7.

Under

this method capital, balances of partners remain constant. (Fixed Capital Method)

8.

Proportion

in which partners share profit. (Profit sharing

ratio)

9.

Such

capital method which only Capital Account is maintained for each partner. (Fluctuating capital method)

10. The account to which all adjustments are made when

capital is fixed. (Current Account)

11. Expenses which

are paid before they are due. (Prepaid Expenses)

12. The accounts that are prepared at the end of each

accounting year. (Final Account)

13. An asset which can be converted into cash easily. (Current Assets or Liquid assets)

14. Order in which

fixed assets are recorded first in the Balance sheet. (Order of liquidation)

15. The account in

which is selling expenses of the businesses are recorded. (Profit and Loss Account)

16. Debit balance of Trading Account. (Gross Loss)

17. Credit balance of Profit and Loss Account. (Net Profit)

C.

State

whether the following statement is True or False with reasons.

1.

Partnership

firm is Non-Trading Concern.

Ans. False.

The main aim of the partnership firm to earn maximum

profit. The partnership is a trading concern. It undertakes either

manufacturing or distributive activities with the sole aim of earning profit

and distributing that profit among the partners in a specific ratio.

2.

Profit

& Loss Account is a Real Account.

Ans. False.

Account of expenses, losses, gain, and incomes is

called Nominal account. Profit & Loss account contains all indirect

expenses and indirect incomes of the firm. Therefore, Profit & Loss Account

is a Nominal Account and not a real account.

3.

Carriage

inward is a carriage on purchase.

Ans. True.

Total transport expenses incurred on bringing the

goods from the market to the place of business is called the carriage. When

goods are purchased, the carriage is supposed to be borne by the firm. It is

known as carriage inward. It means carriage paid on purchase.

4.

Adjustments

are recorded in Partner’s Current Account in fixed capital Method.

Ans. True.

In fixed capital method, as name suggest capital

balance are generally remain fixed. Under this method, adjustments are not to be

recorded in capital account. All adjustments are recorded in a separate account

called Partner’s Current Account.

5.

Prepaid

expenses are treated as liabilities.

Ans. False.

Prepaid expenses are expenses which are paid before

they are due. Therefore, they are considered an asset of the business

organization.

6.

If

the partnership deed is silent, partners share profits and losses in proportion

to their capital.

Ans. False.

As per the provisions made under Indian Partnership

Act 1932, when partnership deed is silent about profit & Loss sharing ratio,

partners are supposed to share profit & losses in equal ratio, and not in

their capital ratio.

7.

Balance

Sheet is an Account.

Ans. False.

Financial statement showing all assets & liabilities

is called Balance sheet. It is not an account. It is a position statement which

shows various assets owned by the firm and various liabilities owned by it. On

the left-hand side all liabilities are listed and on the right-hand side all

assets are recorded.

8.

Wages

paid for the installation of Machinery is a Revenue expenditure.

Ans. False.

Wages paid for the installation of Machinery is a Capital

expenditure. Therefore, it is added to the cost of machinery. It is, generally,

paid once in a life of an asset. It is a long-term and capital expenditure.

9.

Income

received in advance is a liability.

Ans. True.

When income in respect to next year. It received in

the current year. It is known as income received in advance. So, in year firm

will not be able to receive that amount. Therefore, it is considered as a

liability for current year.

10. R.D.D. is created on creditors.

Ans. False.

R.D.D. is create on the value of debtors. Such provision

is made against profit & loss account. In future if loss is incurred on

account of bad debts, such amount is used to run the business.

11. Depreciation is not calculated on current assets.

Ans. True.

Current assets mean liquid assets having no fixed

tenure therefore depreciation can’t be calculated on it. Depreciation is calculated

and charged on fixed assets for their use, wear and tear etc.

12. Goodwill is intangible asset.

Ans. True.

Goodwill is a reputation of business computed in term

of money. Reputation can be experienced but can’t be seen or felt. Therefore,

goodwill is an intangible asset.

13. Indirect expenses are debited to the Trading Account.

Ans. False.

Indirect expenses mean expenses which are not directly

related with production of goods and services. Therefore, indirect expenses

cannot be debited to Trading Account. All indirect expenses are debited to

profit & loss account.

14. Bank loan is a

current liability.

Ans. False.

Loan usually taken for the period more than 1 year

from 5 years from the bank is called Bank Loan. It is long term loan. It is not

repaid within 1 year but pain in installments over number of years. It might be

paid in lumpsum at the expiry of term.

15. Net profit is a

debit balance of profit and loss account.

Ans. False.

In the Profit & Loss Account, when credit side

total i.e., total of incomes is more than the debit side total i.e., expenses

it is known as credit balance. When incomes exceed expenses there is profit. Therefore,

credit balance of Profit & Loss Account indicates net profit.

D.

Find

odd one.

1.

Wages,

Salary, Royalty, Import Duty.

Ans.

Salary

2.

Postage,

Stationery, Advertising, Purchases.

Ans.

Purchases

3.

Capital,

Bills Receivable, Reserve Fund, Bank overdraft.

Ans.

Bills Receivable

4.

Building,

Machinery, Furniture, Bills Payable.

Ans.

Bills Payable

5.

Discount

received, Dividend received, Interest received, Depreciation.

Ans.

Depreciation

E. Complete the sentences.

1.

Partners

share profit & losses in __________ ratio in the absence of partnership

deed.

Ans. Equal

2.

Registration

of partnership is __________ in India.

Ans. Optional

3.

Partnership

business must be __________.

Ans. Lawful

4.

Liabilities

of partners in Partnership firm is __________.

Ans. Unlimited

5.

The

balance of Drawings Account of a partner is transferred to his __________ under

the Fixed Capital Method.

Ans. Current

6.

The

interest on capital of a partner is debited to __________ account.

Ans. Profit & Loss

7.

Partners

are _________ liable for the debts of the firm.

Ans. Joint & Several

8.

Partnership

Deed is an __________ of Partnership.

Ans. Article

9.

The

withdrawal by partner for personal use from the firm is __________ to his account.

Ans. Debited

10. Commission

payable to partner is ___________ to the firm.

Ans. Liability / Outstanding

expenses

11. When partners

adopt Fixed Capital Method then they have to operate __________ Account.

Ans. Partner’s Current

12. If partner’s current account shows __________ balance

it is shown to the liability side of Balance sheet.

Ans. Credit

13. The expenses paid for trading purpose are known as

__________ expenses.

Ans. Trade.

14. Cash receipts which are recurring in nature are called

as __________ receipts.

Ans. Revenue.

15. Return outward are deducted from __________.

Ans. Purchases

16. Expenses which

are paid before due date are called as __________.

Ans. Repaid Expenses

17. Assets which are held in the business for a long

period are called __________.

Ans. Fixed Assets

18. Trading Account is prepared on the basis of is

__________ expenses.

Ans. Direct

19. When commission

is allowed to any partner, it is __________ of the business.

Ans. Expenditure

20. When goods are distributed as free samples, it is

treated as __________ of the business.

Ans. Advertisement expenses.

A.

Answer

in the sentence only:

1.

What

is Fluctuating Capital?

Ans.

When capital balances of the partners go on changing every year due to

transactions of partner with the firm. It is known as Fluctuating Capital.

2.

Why

is Partnership Deed necessary?

Ans. Partnership

deed is necessary to prevent disputes or misunderstandings among the partners

in future.

3.

If

the Partnership Deed is silent, in which ratio, the partners will share the

profit or loss?

Ans.

If the Partnership Deed is silent, partners will share profits and losses in

equal ratio.

4.

What

is the Fixed Capital Method?

Ans.

Fixed Capital Method is one in which capital balances of the partners remains

same at the end of every financial year unless any amount of additional capital

is introduced or part the capital withdrawn by the partner from the business.

5.

How

many partners are required to form a partnership firm?

Ans.

Minimum two persons are required to from a partnership firm.

6.

What

is Partnership Deed?

Ans. A

partnership deed is a written agreement duly stamped and signed document

containing the terms and condition of the partnership.

7.

What

are the objectives of the Partnership firm?

Ans.

To earn maximum profit is the main objective of the partnership firm.

8.

What

rate of interest is allowed on partner’s loan in the absence of an agreement?

Ans.

6% is the rate of interest to be allowed on partner’s loan in the absence of an

agreement.

9.

What

is the minimum number of partners in a partnership firm according to Indian

Partnership Act 1932?

Ans.

Minimum two persons are required number of partners in a partnership firm

according to Indian Partnership Act 1932.

10. What is liability of a partner?

Ans.

Liability of partner (except minor partner) is unlimited.

11. In the absence of Partnership Deed, what is the rate

of interest on loan advance by partner to the firm is allowed?

Ans.

In the absence of partnership deed 6% is the rate of interest loan advance by

partner to be the firm.

12. What do you mean by pre received income?

Ans.

Income which is received by the partnership firm before it is due is called

pre-received income.

13. What is the effect of the adjustment of provision for

discount on debtors in the final accounts of partnership?

Ans. The

effects of the adjustment of provision for discount on debtors in the final

accounts of partnership are as follow:

Debit

Profit & Loss A/c and deduct the amount of provision for discount on

debtors from the amount of debtors.

14. When is Partners Current Account is opened?

Ans. When

Fixed Capital Method is adopted by the firm, Partners Current Account is

opened.

15. As per which principle of accounting, closing stock is

valued at cost price or at market price whichever is less?

Ans. As

per Conservatism principle of accounting, closing stock is valued at cost price

or at market price whichever is less.

16. What is the provision of Indian Partnership Act with

regard to Interest on capital?

Ans. As

per provision of Indian Partnership Act, Interest on capital is not to be

allowed.

17. Why is Balance Sheet prepared?

Ans.

Balance sheet is prepared to know the financial position of the business in the

form of its assets and liabilities on a particular date.

18. Why wages paid for installation of machinery are not shown

in Trading Account?

Ans.

Wages paid for installation of machinery is a capital expenditure and it is not

to be recorded in Trading Account.

19. What do you mean by indirect income?

Ans. All

income other than direct income are called indirect income, [e.g., Interest

received on investment, Incomes like discount, commission, dividend. Rent etc.

received].

20. Why partners’ capital is treated as long term

liability of business?

Ans. Partner’s

Capital is not refunded during the existence of partnership firm unless partner

is retired or expired.

B.

Do

you agree/ disagree with the following statements.

1.

It

is compulsory to have a partnership agreement in writing. Disagree.

2.

Partnership

firm is a trading concern. Agree.

3.

An

interest on capital is an expenditure for the partnership firm. Agree.

4.

Partnership

in an association of two or more person. Agree.

5.

Partners

are entitled to salary or commission. Disagree.

6.

The

balance of Capital Account remains constant under Fixed Capital Method. Agree.

7.

The

Indian Partnership Act, came into existence in the year 1945. Disagree

8.

Profit

& Loss Account reflects the true financial position. Disagree

9.

Amount

borrowed by partner from his business will be debited to current account. Agree.

10. Sold but

underpitched goods must be part of valuation of closing stock. Disagree.

11. Carriage inward is a selling and distribution

overhead. Disagree.

12. Gross profit is an operation profit. Disagree.

13. All financial expenditures are debited to profit and

loss account. Agree.

14. Free distribution of goods is debited to trading

account. Disagree.

15. All financial expenditures are debited to profit

and loss account. Agree.

16. Free

distribution of goods is debited to trading account. Disagree.

C.

Calculate

the following:

1.

Undervaluation

of closing stock by 10%. Closing stock was Rs. 30,000 find out the value of

Closing stock.

Ans. Undervaluation

of closing stock by 10%

Book value

Revised value = --------------------------------- x 100

100 - % undervaluation

30,000

= ------------- x 100 = Rs. 33,333.

100 – 10

Value of closing stock = Rs. 33,333.

2.

Calculate

12.5% P.A. depreciation on Furniture:

(a) On Rs. 2,20,000 for 1 year

(b) On Rs. 10,000 for 6 months

Ans. Depreciation = Amount of

assets x Period x %

(a) Depreciation on furniture = 2,20,000 x 1 x 12.5/100 =

Rs. 27,500

Depreciation

on furniture for 1 year = Rs. 27,500

(b) Depreciation on

furniture = 10,000 x 6/12 x 12.5/100 = Rs. 625

Depreciation on

furniture for 6 months = Rs. 625

Check out all adjustment of Book-Keeping and Accountancy with help to attempt different types of practical questions which is given in Balbharti Maharashtra HSC Board Exam syllabus.

Super 30 Adjustment in Book-Keeping and Accountancy

Practical Problem

Q.1 Amitbhai and Narendrabhai are in Partnership Sharing Profits and Losses equally. From the following Trial Balance and Adjustments given below, you are required to prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as on that date.|

Debit Balance |

Amount |

Credit

Balance |

Amount |

|

Plant and Machinery Factory

Building Sundry

Debtors Purchases Bad debts Sale Return 10% Govt. Bond (Purchased on

1st Oct, 2018) Import Duty Legal Charges Motive Power Warehouse

Rent Cash in Hand Cash at Bank Advertisement (for 2 years,

w.e.f 1st Jan 2019) Salaries Rent Drawing: Amitbhai Narendrabhai Furniture Bills

Receivable Freehold

Property |

|

Capital A/c: Amitbhai Narendrabhai Sales Bills Payable Discount Creditors R.D.D. Bank Loan Purchases

Return |

|

|

|

|

|

|

Adjustments :

|

Debit Balance |

Amount |

Credit

Balance |

Amount |

|

Stock

(1/04/2018) Building Carriage Factory Insurance Postage Bills

Receivable Sundry Debtors Return Inward Purchases Audit fees Loose Tool Manufacturing

Expenses Electricity

Charges General Expenses Export Duty Cash in Hand Bank Balance Conveyance Furniture Salaries Rent, Rate

& Taxes Drawing: Mitesh Mangesh |

25,000 48,500 1,780 2,700 1,600 13,700 52,200 1,600 68,900 1,800 32,000 1,820 2,600 3,400 1,000 75,000 29,000 4,100 64,000 2,000 3,700 1,200 2,200 |

Sundry Creditors Sales Capital A/c: Mitesh Mangesh Outstanding Salaries Bills Payable Return

Outward Current A/c: Mitesh Mangesh |

38,000 1,75,000 1,50,000 50,000 2,000 18,000 1,800 3,000 2,000 |

|

|

4,39,800 |

|

4,39,800 |

|

Debit Balance |

Amount |

Credit

Balance |

Amount |

|

Purchases Sundry

Debtors Sales Return Opening Stock Bad debts Land and

Building Furniture Discount Royalties Rent Salaries Wages Insurance Drawing: Reena Aarti Cash in Hand Cash at Bank |

35,500 40,000 1,000 18,100 500 25,000 20,000 1,000 700 1,900 3,000 800 1,500 2,000 1,000 11,500 2,000 |

Sales Sundry

Creditors Purchases

Return R.D.D. Discount Commission Capital A/c: Reena Aarti |

58,200 25,700 500 800 50 250 50,000 30,000 |

|

|

1,65,500 |

|

1,65,500 |

|

Debit Balance |

Amount |

Credit

Balance |

Amount |

|

Stock

(1/04/2018) Debtors Bills

Receivable Purchases Returns Carriage

Inward Carriage

Outward Motor Vehicles General

Expenses Export Duty Advertisement

(For 3 years

from 1/10/2018) Printing and

Stationery Drawing: Meera Madhav Leasehold

Premises Cash at Bank Furniture |

25,000 80,500 10,000 2,08,500 1,000 3,000 4,500 55,000 1,800 900 4,800 1,200 3,500 2,000 1,10,000 45,000 8,300 |

Bank

Overdraft Bills payable Creditors Sales Outstanding

Rent Unpaid Wages Capital A/c: Meera Madhav Purchases

Return |

5,000 12,500 68,000 3,25,000 2,000 1,500 75,000 75,000 1,000 |

|

|

5,65,000 |

|

5,65,000 |

|

Particulars |

Debit Balance |

Credit Balance |

|

Purchases & Sales Work’s Manager

Salary Capital A/C: Sucheta Gayatri Opening Stock Debtors and

Creditors Wages and

Salaries Bills Receivable Bills Payable Discount Motive Power Custom Duty Interest Unproductive

wages Audit fees Rent Conveyance Goodwill Copyright Building Partner’s

(Sucheta) Loan Investment Cash at Bank |

65,000 2,300

18,700 47,500 4,000 22,000

1,350 1,500

3,000 2,500 1,800 2,000 25,000 20,000 88,000

40,000 26,000 |

1,85,500

75,000 40,000

27,300 400

1,300

6,150

|

|

|

3,70,650 |

3,70,650 |

Trial

Balance as on 31st March, 2019

|

Debit Balance |

Amount |

Credit Balance |

Amount |

|

Stock

(1/04/2018) Patents Sundry Debtors Stock of

Stationery Trade Mark Bills Receivable Electricity

charges Wages Heating and Lighting Trade Expenses Sales Return Land & Building Furniture Cash at Bank Investment Drawing; Archana Prerana Bad debts Purchases |

8,560 2,000 18,500 3,000 2,000 6,300 1,450 950 1,000 850 400 22,000 13,000 5,000 7,500

1,200 900 200 23,700 |

Capital A/c: Archana Prerana Others Loan Reserve Fund Sundry creditors Bills Payable Purchases Return R.D.D. Sales Interest |

40,000 20,000 3,000 1,000 17,500 5,000 1,000 500 30,200 310 |

|

|

1,18,510 |

|

1,18,510 |

Adjustments :

1) Stock on 31st March 2019 is valued at Cost Price Rs.

12,000 and Market Price Rs. 17,000.

2) Our customer Mr. Shekhar failed to pay his dues of Rs.

800.

3) 1/8th of Patents is to be written off.

4) A part of Furniture Rs. 5,000 is purchased on 1st

Oct 2018.

5) Depreciation on Land & Building 10% and on

Furniture 5%.

6) Outstanding Expenses Wages Rs. 300 and Electricity

Charges Rs. 200.

7) Allow Interest on Capital 3%.

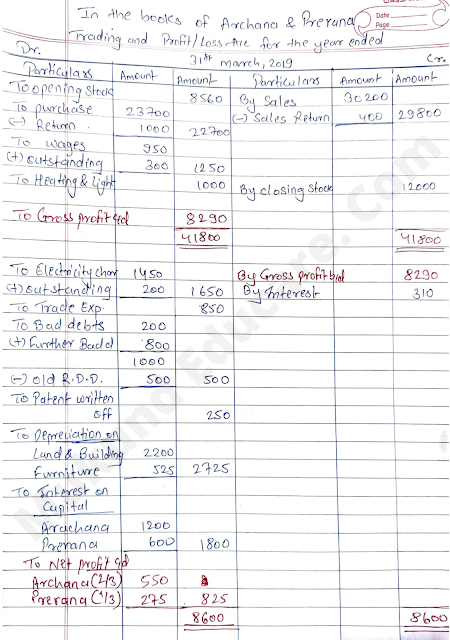

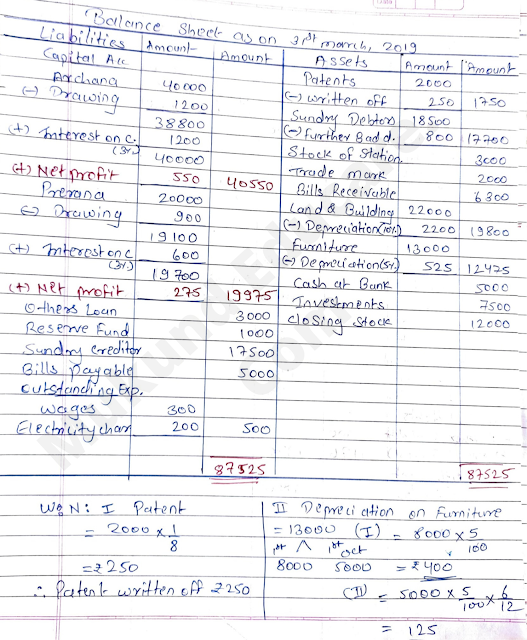

(Ans : G.P. Rs. 8,290, N.P. Rs. 825 Balance Sheet Total Rs. 87,525) [ Solution ]

Q.7 Satish and Pramod are Partners. Prepare Trading Account and Profit and Loss Account for the year 31st March, 2019. You have to find out Gross Profit and Net Profit only.

Trial

Balance as on 31st March, 2019

|

Debit Balance |

Amount |

Credit Balance |

Amount |

|

Stock

(1/04/2018) Purchases Wages Insurance Unproductive Wages Warehouse Rent Carriage Outward Sales Return Export Duty Custom Duty Sundry Debtors Investment Factory Rent Postage and

Telegram |

8,700 18,300 1,000 800 1,400 600 1,200 600 1,400 800 40,000 15,700 1,600 400

|

Sales Dividend Purchases Return Sundry Creditors 10% Bank Loan (w.e.f.

1/7/2018) Other Receipts |

68,000 2,000 500 13,000 8,000

1,000 |

|

|

92,500 |

|

92,500 |

Adjustments :

1) The Closing Stock is valued at Rs. 15,400.

2) Outstanding Wages Rs. 500.

3) Create provision for Bad debts Rs. 800 and maintain

R.D.D 3% on Sundry Debtors.

4) Goods of Rs. 1,800 distributed as a free sample.

5) Goods of Rs. 2,000 were sold and delivered on 31st March 2019 but no entry is passed in the Books of Account.

(Ans : G.P. Rs. 56,200, N.P. Rs. 48,964 ) [ Solution ]

Q.8 Nana and Nani are Partners in Partnership Firm sharing Profits and Losses equally. You are required to give effects of Adjustments in Profit & Loss A/c and Balance Sheet with the help of following information.

Trial Balance as

on 31st March, 2019

|

Debit Balance |

Amount |

Credit Balance |

Amount |

|

Insurance Land and

Building (Additional Rs. 20,000 w.e.f. 1stJuly, 2018 ) Salaries Export Duty Interests Furniture Debtors |

15,000 50,000 5,000 2,500 1,000 40,000 26,000 |

Capital A/c: Nana Nani 10% Bank Loan

taken on 1st Oct. 2018 Interest Bills payable |

50,000 50,000 30,000 1,500 8,000 |

|

|

1,39,500 |

|

1,39,500 |

1) Gross profit amounted to Rs. 34,500.

2) Insurance Paid for 15 months w.e.f. 1.4.2018.

3) Depreciate Land and Building at 10% p.a. and Furniture at

5% p.a.

4) Write off Rs. 1,000 for Bad Debts and maintain R.D.D at

5% on Sundry Debtors.

5) Closing Stock is valued at Rs. 34,500.

(Ans : N.P. Rs. 5,250 Balance Sheet Total Rs. 1,44,750) [ Solution ]

Trial Balance as

on 31st March, 2019

|

Debit Balance |

Amount |

Credit Balance |

Amount |

|

Land and

Building Furniture Machinery (Purchases on

1/7/2018) Goodwill Wages Current A/c:

Moon 8% Debenture (Purchases on

1/10/2018) Provident

Fund Investment Stock of

Postal stamps |

40,000 18,000 40,000 2,000 2,000 4,000 8,000 3,500 500 |

Capital A/c: Sun Moon Current A/c: Sun Sundry

Creditors Bank overdraft Reserve fund Provident fund |

33,500 33,500 6,000 25,000 10,000 5,000 5,000 |

|

|

1,18,000 |

|

1,18,000 |

1) Partners are entitled to get salary Rs. 6,000 p.a. in

addition to their profit & loss sharing.

2) Depreciation on Land & Building, Furniture &

Machinery @ 10%, 5% and 3% respectively.

3) Interest on Capital 5% p.a.

4) Closing Stock Rs. 60,743.

5) Wages included Rs. 1,000 as advance given to workers.

6) Interest due but not paid Rs. 800.

7) Total Net Profit amounted to Rs. 38,113.

You are required to prepare Balance Sheet and Partners

Current A/c only.

(Ans : Balance Sheet Total Rs. 1,68,263, Current A/c Balance Sun Rs. 32,731, Moon Rs. 22,732)

Kshipra and Manisha are Partners sharing Profit and Losses

in their Capital Ratio. You are required to prepare Trading Account and Profit

and Loss Account for the year ended 31st March, 2019 and Balance Sheet as on

that date.

Trial Balance as

on 31st March, 2019

|

Debit Balance |

Amount |

Credit Balance |

Amount |

|

Sundry Debtors Purchases Furniture Plant &

machinery Wages Salaries Discount Bills Receivable Carriage outward Postage Sale Return Cash in hand Cash at Bank Insurance Opening stock Trade

Expenses Warehouse

Rent Advertisement Building |

28,000 55,000 38,500 60,000 800 3,500 800 14,400 1,000 500 500 4,000 47,000 2,000 17,800 1,500 2,500 1,000 20,000 |

Sales Rent Sundry

Creditors Purchase Return Discount Bills payable Capital A/c: Kshipra Manisha Current A/c: Kshipra Manisha |

1,20,000 1,800 38,500 1,000 500 9,000 90,000 30,000 5,000 3,000 |

|

|

2,98,800 |

|

2,98,800 |

1) Stock on 31st March 2019 was at Rs. 37,000.

2) Sales includes, sale of machinery of Rs. 2,000, which is

sold on 1st April 2018.

3) Depreciation on fixed assets @ 5%.

4) Each Partners is entitled to get Commission at 1% of

Gross Profit and Interest on Capital 5% p.a.

5) Outstanding Expenses Wages Rs. 200 & Salaries Rs. 500.

6) Create provision for doubtful debts @ 3% on Sundry

Debtors.

(Ans : G.P. Rs. 81,700, N.P. ` 56,401 Balance Sheet Total

Rs. 2,40,235) [ Solution ]

Click Here to Download Practice Question Paper & Get ready for Board Exam:

Bk & Accountancy Practice Test Paper : Chapter 1, 3 & 5

Bk & Accountancy Practice Test Paper: Chapter 2, 4 ,6 & 8

Economics Practice Paper: 2

Economics Practice Paper: 3

HSC Commerce 12th Board Exam- Maharashtra State Board Textbook Solutions

Chapter 2 - Not for Profit Concerns

Chapter 4 - Retirement of Partner

Chapter 5 - Death of Partner

Chapter 6 - Dissolution of Partner

Chapter 7 Bill of Exchanges

.png)

.png)

0 Comments