Paper/Subject Code: 85502/Security Analysis and Portfolio Management

TYBBI SEM-6

Security Analysis and Portfolio Management

(QP April 2019 with Solutions)

NB: (1) All questions are compulsory.

(2) Figures to the right indicate marks allotted to each question.

1. (A) Match the following. (Any 8) (08 Marks)

|

Group Á |

Group B |

|

(a) Equity

share |

(1) Debt Fund |

|

(b)

Preference share |

(2)

Discounted value |

|

(c)

Fundamental analysis |

(3) Fixed

Dividend |

|

(d) PPF |

(4) Unsecured

Deposit |

|

(e) Public

Deposit |

(5) Tax

Saving Investment |

|

(f)

Investment Bank |

(6)

Registered office |

|

(g) Post

Office |

(7) Initial

public offering |

|

(h) Present

Value |

(8) Ratios |

|

(i) Bond |

(9) Bear

Market |

|

(j)

Expectation to fall price |

(10) Risky

Capital |

Ans:

Group Á | Group B |

(a) Equity share | (10) Risky Capital |

(b) Preference share | (3) Fixed Dividend |

(c) Fundamental analysis | (8) Ratios |

(d) PPF | (5) Tax Saving Investment |

(e) Public Deposit | (4) Unsecured Deposit |

(f) Investment Bank | (7) Initial public offering |

(g) Post Office | (6) Registered office |

(h) Present Value | (2) Discounted value |

(i) Bond | (1) Debt Fund |

(j) Expectation to fall price | (9) Bear Market |

1. (B) Give True or False: (Any 7) (07 Marks)

1. Small-cap stocks tend to offer more growth potential than large-cp stocks.

Ans: True

2. Risk is highest in callable bonds.

Ans: False

3. The higher the risk of a security, the lower would be the return expected from it.

Ans: False

4. Speculative activities are harmful.

Ans: True

5. Fundamental analysis is a method of evaluating a security.

Ans: True

6. Examples of solvency ratio include current ratio and quick ratio.

Ans: False

7. Price level and inflation affect the economy of the country.

Ans: True

8. The efficient market hypothesis (EMH) states that the financial markets are inefficient.

Ans: False

9. Risk is measured by variability in returns.

Ans: True

10. A risky asset is one whose return is certain as a Government Security.

Ans: False

Q.2 (a) Distinguish between investment and Speculation? (08 Marks)

|

|

Investment |

Speculation |

|

Objective |

To earn

steady and reasonable returns over the long term. |

To earn quick

and high returns through short-term price fluctuations. |

|

Time Horizon |

Long-term,

often years or decades. |

Short-term,

often days, weeks, or months. |

|

Risk Level |

Lower risk;

focuses on minimizing risk through analysis and diversification. |

High risk;

involves higher chances of loss due to price volatility. |

|

Basis of

Decision |

Based on

fundamental analysis, research, and intrinsic value of the asset. |

Often based

on market trends, rumors, or technical analysis. |

|

Return

Expectation |

Moderate but

consistent returns over time. |

High and

uncertain returns, sometimes speculative gains. |

|

Capital

Safety |

Prioritizes

the safety of capital while generating returns. |

Safety of

capital is secondary to potential gains. |

|

Market

Behavior |

Invests based

on market stability and economic growth prospects. |

Exploits

market inefficiencies and volatility for short-term gains. |

|

Nature |

Focuses on

wealth creation and accumulation. |

Focuses on

profiting from rapid market movements. |

|

Involvement |

Generally

passive, with less frequent buying and selling. |

Active and

frequent buying and selling to capitalize on market movements. |

|

Example |

Buying

blue-chip stocks, bonds, or mutual funds for long-term growth. |

Day trading,

buying penny stocks, or trading in derivatives like options. |

(b) Explain the phases of Portfolio Management. (07 Marks)

Portfolio management involves a systematic approach to managing investments to meet specific financial objectives. The process is divided into several phases:

1. Planning Phase

This is the foundation of portfolio management where objectives and constraints are established.

- Activities:

- Understanding Client Objectives: Define goals such as capital appreciation, income generation, or risk minimization.

- Assessing Risk Tolerance: Evaluate the investor’s willingness and ability to bear risk.

- Determining Investment Horizon: Establish the time period for investments (short, medium, or long term).

- Identifying Constraints: Consider liquidity needs, tax implications, legal constraints, and unique requirements.

2. Security Analysis Phase

This phase involves identifying and analyzing potential investment options.

- Activities:

- Fundamental Analysis: Study financial statements, earnings, and growth potential to determine intrinsic value.

- Technical Analysis: Analyze price charts, trends, and patterns to forecast future price movements.

- Economic and Industry Analysis: Assess macroeconomic indicators and the performance of specific industries.

3. Portfolio Construction Phase

This phase focuses on the allocation of funds to different asset classes and securities.

- Activities:

- Asset Allocation: Distribute investments among asset classes (e.g., equity, bonds, real estate).

- Diversification: Spread investments across sectors and geographies to reduce risk.

- Optimization: Create a mix of assets that maximizes return for a given level of risk.

- Selection: Choose individual securities based on the analysis.

4. Portfolio Monitoring and Rebalancing Phase

In this phase, the portfolio's performance is tracked and adjusted as needed.

- Activities:

- Performance Review: Regularly evaluate the portfolio against benchmarks and objectives.

- Rebalancing: Adjust the asset allocation to align with the investor’s changing goals or market conditions.

- Risk Management: Monitor for overexposure to specific risks and take corrective actions.

5. Performance Evaluation Phase

The final phase involves assessing the overall success of the portfolio.

- Activities:

- Measuring Returns: Compare actual returns to expected returns and benchmarks.

- Analyzing Risk-Adjusted Performance: Use metrics like Sharpe ratio, Treynor ratio, or Jensen’s alpha to evaluate performance.

- Feedback Loop: Use insights from evaluation to improve future investment strategies.

OR

2. The rate of return of stock Alpha and Beta under different status of economy are given below:

|

Particular |

Boom |

Normal |

Recession |

|

Probability |

0.35 |

0.50 |

0.15 |

|

Return of

stock Alpha (%) |

30 |

50 |

70 |

|

Return of

stock Beta (%) |

70 |

50 |

30 |

(a) Calculate the expected return and standard deviation of return on both the stock.

(b) If you could invest in either stock Alpha or stock Beta, but not in both.

(c) Which stock would you prefer?

3. Following information is available relating to X Limited and Y Limited. (15 Marks)

|

Particulars |

X Limited |

Y Limited |

|

Equity Share

Capital (Rs.10 face value) |

Rs.300 lakhs |

Rs.350 lakhs |

|

Profit after

tax |

Rs.50 lakhs |

Rs.70 lakhs |

|

Proposed

Dividend |

Rs.35 lakhs |

Rs.40 lakhs |

|

Market Price

Per Share |

Rs.200 |

Rs.280 |

|

Current

Assets |

Rs.80 lakhs |

Rs.90 lakhs |

|

Current

Liabilities |

Rs.40 lakhs |

Rs.45 lakhs |

Calculate:

(i) Earnings per share

(ii) P/E Ratio

(iii) Dividend Payout Ratio

(iv) Return on Equity Shares

(v) Current Ratio

As an analyst inform the investor which is good in investing. (15 Marks)

OR

Q. 3. (a) Explain Technical Analysis and principles of Technical Analysis. (08 Marks)

Technical Analysis is a method used to evaluate securities, such as stocks, commodities, or currencies, by analyzing statistical trends gathered from trading activity. These activities include price movements, volume, and other market behavior indicators. Unlike fundamental analysis, which focuses on a company’s financial health and economic factors, technical analysis relies on historical price charts and patterns to predict future price movements.

It is widely used by traders and investors to make short-term trading decisions, although it can also be applied to longer-term strategies.

Principles of Technical Analysis

Technical Analysis is based on three main principles:

1. Market Action Discounts Everything

- This principle asserts that all relevant information (economic, political, or psychological factors) is already reflected in the price of the security.

- Instead of analyzing external factors, technical analysts focus solely on price movements and trading volume.

2. Prices Move in Trends

- Price movements are not random but tend to follow identifiable trends or patterns.

- Trends can be upward (bullish), downward (bearish), or sideways (consolidating).

- The primary objective of technical analysis is to identify these trends early and trade in their direction.

3. History Tends to Repeat Itself

- Human psychology and market behavior often repeat over time, leading to recurring price patterns and chart formations.

- Technical analysts study past patterns to predict future price movements, relying on tools such as support and resistance levels, candlestick formations, and chart patterns like head-and-shoulders or double tops.

Tools and Concepts in Technical Analysis

Charts

- Line Charts: Show a security's closing prices over time.

- Bar Charts: Include opening, closing, high, and low prices for a specific period.

- Candlestick Charts: Similar to bar charts but more visually descriptive, widely used for pattern recognition.

Indicators

- Trend Indicators: Moving Averages, Bollinger Bands.

- Momentum Indicators: Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD).

- Volume Indicators: On-Balance Volume (OBV), Volume Oscillator.

Support and Resistance

- Support: A price level where demand is strong enough to prevent the price from falling further.

- Resistance: A price level where selling pressure prevents the price from rising further.

Chart Patterns

- Reversal Patterns: Indicate a change in the trend (e.g., head-and-shoulders, double top/bottom).

- Continuation Patterns: Suggest the trend will continue (e.g., flags, pennants).

Dow Theory

- This foundational theory for technical analysis emphasizes the primary trend, secondary trend, and minor trend. It underlines how markets move in phases and helps in trend identification.

Strengths and Weaknesses of Technical Analysis

Strengths

- Focus on price action eliminates the need for complex financial analysis.

- Can be applied across various markets and timeframes.

- Helps identify optimal entry and exit points.

Weaknesses

- Relies heavily on historical data, which may not always predict future outcomes.

- Subjective interpretation can lead to inconsistency.

- Effectiveness can decrease in highly unpredictable or low-volume markets.

(b) Explain Operating Leverage and Financial Leverage and its uses. (07 Marks)

Leverage refers to the use of fixed costs—whether operating or financial—to magnify the potential returns to shareholders. It can increase both profits and risks. The two primary types of leverage are Operating Leverage and Financial Leverage.

1. Operating Leverage

Operating leverage measures how a company's operating income (EBIT) is affected by changes in sales. It arises from the presence of fixed costs in the production process.

Formula for Degree of Operating Leverage (DOL):

Where:

- Contribution Margin = Sales Revenue - Variable Costs

- EBIT = Earnings Before Interest and Taxes

Characteristics:

- High Operating Leverage: Companies with a higher proportion of fixed costs (e.g., rent, depreciation) relative to variable costs have high operating leverage. Small increases in sales lead to larger increases in operating income.

- Low Operating Leverage: Companies with predominantly variable costs have low operating leverage.

Uses of Operating Leverage:

- Profit Amplification: It can magnify profits as sales grow, making it advantageous during periods of high demand.

- Break-Even Analysis: Helps determine the sales volume required to cover fixed costs.

- Strategic Planning: Guides decisions about cost structure and investment in fixed vs. variable costs.

Risks:

- High operating leverage increases the risk during downturns since fixed costs must be paid regardless of sales volume.

2. Financial Leverage

Financial leverage measures how a company's net income is affected by changes in EBIT due to the use of fixed financial costs, such as interest on debt.

Formula for Degree of Financial Leverage (DFL):

4. (a) The details of three portfolios are given below.

|

Portfolio |

Return on

Portfolio (%) |

Beta |

Standard

Deviation (%) |

|

Sony |

18 |

1.2 |

28 |

|

Mony |

12 |

0.8 |

32 |

|

Tony |

16 |

1.1 |

36 |

|

Market Index |

14 |

1.0 |

22 |

Compare these portfolio on performance using Sharpe and Treynor measures.

Risk Free return is 8%. (08 Marks)

4. (b) A Government of India bond of Rs.1,000 each has a coupon rate of 7.5% p.a. and maturity period is 10 years. If the current market price is Rs. 960. Find YTM. (07 Marks)

OR

(c) Give assumptions of the Efficient Market Hypothesis. (08 Marks)

The Efficient Market Hypothesis (EMH) is based on the idea that financial markets are "informationally efficient," meaning that prices of securities at any given time reflect all available information. The following are key assumptions underlying the EMH:

Rational Behavior of Investors

Investors act rationally and use all available information to make decisions. They aim to maximize utility based on this information.Information Availability

All relevant information is freely and instantly available to all market participants. This includes public announcements, financial statements, and news about macroeconomic factors.Rapid Price Adjustment

Prices of securities adjust almost instantaneously to reflect new information. This implies that it is impossible to consistently achieve abnormal profits by trading on information that is publicly available.Random Walk of Prices

Since prices fully reflect all current information, any new information is unpredictable, leading to price changes that follow a random walk. This makes future price movements unpredictable based on past trends.Homogeneous Expectations

All investors interpret and react to information in a similar manner, leading to a consensus about the value of a security.No Transaction Costs

The assumption is that there are no transaction costs or taxes that would impede trading, allowing information to flow freely through the market.Infinite Divisibility and Liquidity

Securities can be divided into infinitely small parts, and markets are perfectly liquid, enabling investors to buy or sell any quantity without impacting prices.No Arbitrage Opportunities

If any arbitrage opportunities arise, they are quickly exploited by investors, driving prices back to their fair value and eliminating the opportunities.

The EMH has three forms, each with different levels of assumptions about information efficiency:

- Weak Form: Assumes that all past trading information is reflected in prices.

- Semi-Strong Form: Assumes that all publicly available information is reflected in prices.

- Strong Form: Assumes that all information, both public and private, is reflected in prices.

These assumptions form the basis for the EMH but have been subject to criticism and challenges, particularly due to behavioral economics and market anomalies.

(d) Explain Capital Market Line with diagram. (07 Marks)

The Capital Market Line (CML) is a graphical representation of the risk-return relationship for efficient portfolios in the context of the Capital Asset Pricing Model (CAPM). It shows the expected return of a portfolio as a linear function of its risk, measured by standard deviation, under the assumption of a risk-free asset.

Equation of the Capital Market Line

The equation for the CML is:

Concepts

Risk-Free Asset (R):

The CML starts at the risk-free rate on the vertical axis, where the portfolio's risk () is zero.Market Portfolio:

The point where the CML touches the efficient frontier is the market portfolio. It represents the highest return per unit of risk.Efficient Portfolios:

Only efficient portfolios lie on the CML. These portfolios are combinations of the market portfolio and the risk-free asset.Slope of the CML:

The slope is called the market price of risk:

Diagram Explanation

Below is a typical representation of the CML:

- Horizontal Axis (X-Axis): Measures risk (, the standard deviation).

- Vertical Axis (Y-Axis): Measures the expected return ().

- The Risk-Free Rate: The CML starts at on the Y-axis, representing a zero-risk investment.

- The Efficient Frontier: The CML touches the efficient frontier at the market portfolio.

- Portfolios on the CML: Any point on the CML represents a combination of the risk-free asset and the market portfolio.

The diagram above illustrates the Capital Market Line (CML):

- The CML (blue line) starts at the risk-free rate () and passes through the market portfolio ().

- The efficient frontier (green dashed curve) represents the set of optimal portfolios based on risk-return trade-offs without the risk-free asset.

- The risk-free asset is represented by the red dot on the Y-axis.

- The market portfolio is shown as the purple point where the CML is tangent to the efficient frontier.

The CML shows how combining the risk-free asset with the market portfolio creates efficient portfolios for investors, balancing risk and return.

5. (a) Returns of Apple Limited and Orange Limited are given for four years with market returns.

You are required to compute Beta of Apple Limited and Orange Limited (08 Marks)

|

Year |

Apple

Limited (%) |

Orange

Limited

|

Market (%)

|

|

1 |

11 |

13 |

12 |

|

2 |

13 |

14 |

14 |

|

3 |

12 |

11 |

14 |

|

4 |

10 |

10 |

16 |

(b) What are the three forms of efficient market? Explain. (07 Marks)

The Efficient Market Hypothesis (EMH), proposed by economist Eugene Fama, states that financial markets are efficient, meaning that all available information is fully reflected in asset prices. EMH is categorized into three forms based on the type of information incorporated into prices:

1. Weak Form Efficiency:

- Definition: All past market data, such as historical prices, trading volumes, and patterns, are fully reflected in the current market prices.

- Implications:

- Investors cannot achieve above-average returns using technical analysis (analysis based on past price trends and charts).

- Price changes are random and unpredictable due to the market already incorporating historical information.

- Example: Stock prices do not exhibit patterns or trends that can be consistently exploited for profit.

2. Semi-Strong Form Efficiency:

- Definition: In addition to historical data, all publicly available information (e.g., financial statements, news releases, macroeconomic indicators) is also fully incorporated into market prices.

- Implications:

- Fundamental analysis (evaluation of a company's financial health) cannot consistently lead to abnormal returns since the information is already reflected in stock prices.

- Only new and unexpected information can cause price changes.

- Example: A company's stock price adjusts almost immediately after a public earnings report or major news event.

3. Strong Form Efficiency:

- Definition: All information, including historical, public, and even private or insider information, is fully reflected in current market prices.

- Implications:

- No investor, including insiders with non-public information, can consistently achieve above-average returns.

- Markets are perfectly efficient in this form, which is rare in reality.

- Example: Even insider trading would not yield abnormal profits because prices already account for all private information.

OR

Q.5. Give short notes on: (Any three) (15 Marks)

1. Mutual Fund

A Mutual Fund is a pooled investment vehicle that collects money from multiple investors to invest in a diversified portfolio of assets such as stocks, bonds, money market instruments, or other securities. It is managed by professional fund managers and provides investors with an affordable way to access a diversified and professionally managed portfolio.

Features:

Diversification:

- Mutual funds spread investments across a variety of assets, reducing the impact of poor performance by any single security.

Professional Management:

- Qualified fund managers make investment decisions based on research and market analysis, saving investors the effort and expertise required for individual investing.

Liquidity:

- Mutual funds offer high liquidity, allowing investors to redeem their units at the current Net Asset Value (NAV) on business days.

Affordability:

- Investors can start with small amounts, making mutual funds accessible to individuals with limited capital.

Variety:

- Mutual funds offer various types tailored to different risk appetites and financial goals, such as equity funds, debt funds, balanced funds, and sector-specific funds.

Types of Mutual Funds:

- Equity Funds: Focus on stocks and aim for high growth potential.

- Debt Funds: Invest in fixed-income instruments like bonds for stable returns.

- Hybrid Funds: Combine equities and debts for a balanced risk-return profile.

- Index Funds: Track and replicate the performance of a market index like the S&P 500.

- Money Market Funds: Invest in short-term instruments for low-risk, low-return objectives.

Advantages:

- Easy accessibility and transparency.

- Tax benefits on certain schemes (e.g., ELSS in India).

- Regulated and monitored by authorities (e.g., SEBI in India, SEC in the USA).

Disadvantages:

- Management fees and expenses.

- Returns are subject to market risks.

- No control over individual investments.

Mutual funds are an excellent choice for investors seeking diversification, professional management, and convenience in achieving their financial goals.

2. Markowitz Model

The Markowitz Model, also known as Modern Portfolio Theory (MPT), was developed by economist Harry Markowitz in 1952. It provides a framework for constructing an optimal portfolio that maximizes returns for a given level of risk or minimizes risk for a desired level of return.

Concepts:

Diversification:

- The model emphasizes the importance of diversifying investments across different assets to reduce portfolio risk.

- By combining assets with varying correlations, the overall risk of the portfolio can be minimized.

Efficient Frontier:

- The efficient frontier represents a set of portfolios that offer the highest expected return for a given level of risk.

- Portfolios on the efficient frontier are considered optimal, while portfolios below the frontier are suboptimal.

Risk and Return:

- Risk is measured by the standard deviation of portfolio returns.

- Return is the expected average return of the portfolio based on historical or projected data.

Correlation:

- The degree to which two asset returns move in relation to each other is critical.

- Lower correlation between assets results in greater risk reduction when combined.

Assumptions:

- Investors are rational and risk-averse.

- Markets are efficient, with all information readily available.

- Returns are normally distributed.

- Risk is measured solely by variance or standard deviation.

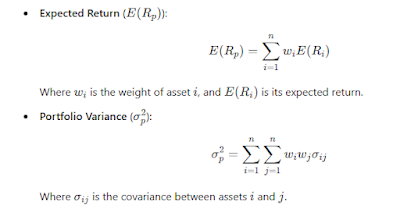

Markowitz Model Formula:

For a portfolio with assets:

Significance:

The Markowitz Model laid the foundation for modern finance by introducing the concept of risk-return trade-off and portfolio optimization. It is widely used by portfolio managers and investors to design diversified investment strategies.

3. Bond Risk

Bonds, though generally considered safer than stocks, are subject to various types of risks that can impact their value and returns. Understanding these risks is crucial for making informed investment decisions.

Types of Bond Risk:

Interest Rate Risk:

- Definition: The risk of bond prices falling due to rising interest rates.

- Explanation: Bond prices and interest rates have an inverse relationship. When interest rates rise, new bonds offer higher yields, making existing bonds with lower yields less attractive.

- Impact: Long-term bonds are more sensitive to interest rate changes than short-term bonds.

Credit Risk (Default Risk):

- Definition: The risk that the bond issuer may fail to meet its obligations, such as paying interest or principal.

- Explanation: Bonds issued by entities with poor credit ratings have a higher chance of default.

- Mitigation: Investors can manage this risk by choosing bonds with high credit ratings (e.g., AAA-rated bonds).

Inflation Risk:

- Definition: The risk that inflation erodes the purchasing power of a bond’s fixed interest payments.

- Explanation: Inflation reduces the real return on bonds, especially those with fixed interest rates.

- Impact: Bonds with longer maturities are more vulnerable to inflation risk.

Liquidity Risk:

- Definition: The risk of difficulty in selling a bond without significantly affecting its price.

- Explanation: Some bonds, especially those from small issuers or in thinly traded markets, may lack buyers, making them less liquid.

- Mitigation: Investing in government or widely traded corporate bonds can reduce this risk.

Call Risk:

- Definition: The risk that a bond issuer will repay the bond before its maturity date.

- Explanation: Callable bonds allow issuers to redeem the bond early, typically during periods of falling interest rates, leaving investors to reinvest at lower rates.

- Impact: Reduces the potential returns for investors.

Reinvestment Risk:

- Definition: The risk of reinvesting bond coupon payments at lower interest rates.

- Explanation: Occurs in a declining interest rate environment, reducing overall returns for investors.

4. Types of Leverages

Leverage refers to the use of fixed costs or fixed obligations in a business to amplify returns for stakeholders. It can be categorized into three main types:

1. Operating Leverage:

- Definition: Measures the impact of fixed operating costs (like rent, depreciation, salaries) on a company’s operating income (EBIT).

- Key Idea: A company with high fixed costs relative to variable costs has high operating leverage, making its EBIT more sensitive to changes in sales.

- Formula:

Implication: High operating leverage increases potential profitability but also risk, as a drop in sales can significantly affect profits.

2. Financial Leverage:

- Definition: Focuses on the use of fixed financial costs, such as interest on debt, to influence returns to equity shareholders.

- Key Idea: Financial leverage arises when a company uses debt financing to fund operations, amplifying profits (or losses) for equity holders.

- Formula:

3. Combined Leverage:

- Definition: Combines the effects of operating and financial leverage to assess the overall risk and return of the business.

- Key Idea: It evaluates the impact of fixed costs (both operating and financial) on the earnings per share (EPS) relative to sales changes.

- Formula:

- Implication: High combined leverage indicates greater sensitivity of EPS to sales fluctuations, emphasizing both operational and financial risks.

- Operating Leverage focuses on operating costs.

- Financial Leverage deals with financial obligations.

- Combined Leverage reflects the cumulative effect of both.

5. Arbitrage Pricing Theory

Arbitrage Pricing Theory (APT) is a financial model used to determine the fair market price of an asset while considering multiple risk factors that influence its returns. Developed by economist Stephen Ross in 1976, APT is an alternative to the Capital Asset Pricing Model (CAPM) and offers more flexibility by allowing for multiple sources of systematic risk.

Features of APT:

Multi-Factor Model: APT assumes that an asset's return is influenced by several macroeconomic factors or market indices, such as inflation, interest rates, GDP growth, and others, rather than just the market risk as in CAPM.

No Arbitrage Assumption: The theory is based on the principle that arbitrage opportunities (riskless profits) cannot persist in efficient markets, as investors would exploit them until the prices adjust to eliminate such opportunities.

Linear Relationship: The expected return of an asset is modeled as a linear function of its sensitivity (beta) to various risk factors and the risk premiums associated with those factors.

APT Formula:

Where:

- : Expected return of the asset

- : Risk-free rate

- : Sensitivity of the asset to factor

- : Risk premium of factor

Advantages:

- More flexible than CAPM as it considers multiple risk factors.

- Better suited for explaining asset pricing in diverse markets.

Limitations:

- Identifying relevant risk factors and their associated premiums can be challenging.

- Assumes market efficiency and no arbitrage, which may not always hold true.

APT is widely used in portfolio management and financial analysis, especially in markets where multiple factors drive asset prices.

.png)

.png)

0 Comments