Chapter -6

Correspondence with Members

__________________________________________________________________________________

Q.1 A) Select the correct answer from the options given below and rewrite the statement.

1. Directors are the .................. .

a) paid employee of the company

b) representatives of the share holders

c) creditors of the company

Ans: b) Representative of the share holders

2. Dividend is to be paid to the shareholders within .............. days from the date of declaration.

a) 30

b) 40

c) 20

Ans: a) 30

3. Registered shareholders receive dividend through .............. warrant.

a) share

b) debenture

c) dividend

Ans: c) dividend

4. Shares issued free of cost to the shareholders are known as ................. shares.

a) preference

b) equity

c) bonus

Ans: c) Bonus

5. Share Certificate should be ready for delivery by the company within ................. months after the allotment of shares.

a) 3

b) 5

c) 2

Ans: c) 2

6. Secretarial correspondence with members should be ................. .

a) lengthy

b) shortcut

c) prompt and precise

Ans: c) Prompt and precise

7. Dividend is recommended by ................. .

a) Board of Directors

b) shareholders

c) Depositors

Ans: a) Boards of Depositors

8. Dividend is paid out of ................. of the company.

a) Capital

b) Building Fund

c) Profit

Ans: c) Profit

9, ................. is issued by the company to its registered shareholders after the declaration of dividend at the Annual General Meeting of the company.

a) Dividend Warrant

b) Interest Warrant

c) Share Warrant

Ans: a) Dividend Warrant

B) Match the pairs.

|

Group A

|

Group B

|

|

a) Dividend

Warrant

|

1) Instrument

for payment of interest

|

|

b) Return

on Shares

|

2) Capitalization

of Building fund

|

|

c) Bonus

Share

|

3) Electronic

Clearing Service

|

|

d) ECS

|

4) Capitalization

of Reserve fund

|

|

e) NEFT

|

5) National

Electronic Fund Transfer

|

|

|

6) Dividend

|

|

|

7) Electronics

Co-operative Society

|

|

|

8) National

Electronic Fixed Transfer

|

|

|

9) Instrument

for Payment of Dividend

|

|

|

10) Interest

|

Ans:

|

Group A

|

Group B

|

|

a) Dividend

Warrant

|

9) Instrument

for payment of Dividend

|

|

b) Return

on Shares

|

6) Dividend

|

|

c) Bonus

Share

|

4) Capitalization

of Reserve fund

|

|

d) ECS

|

3) Electronic

Clearing Service

|

|

e) NEFT

|

5) National

Electronic Fund Transfer

|

C) Write a word or a term or a phrase which can substitute each of the following statements.

1. Shares given free of cost to the existing equity shareholders.

Ans: Bonus share

2. Instrument for payment of dividend.

Ans: Dividend Warrant

3. The shareholders to whom the bonus shares are issued.

Ans: Equity shareholders

4. The authority which recommends the rate of dividend.

Ans: Board of directors

5. An officer who comes into contact with all the members of the company through

correspondence.

Ans: Company Secretary

6. A special kind of cheque issued by a company on its banker to pay certain sum of money as dividend to its members.

Ans: Dividend Warrant

D) State whether the following statements are true or false.

1. Bonus shares are issued to existing equity shareholders.

Ans: True

2. Building fund is used for issue of bonus shares.

3. Bonus shares means capitalisation of reserve fund.

4. Registered shareholder gets dividend through dividend coupons.

5. Dividend is the portion of the profits of the company which is allotted to the holders of the debentures of the company.

6. Every company must issue or despatch a share certificate to the allottee within three

months after allotment of shares .

7. A complaint letter should not be replied promptly.

Ans: False

E) Find the odd one.

1. Secrecy, Dividend, Interest.

Ans: Secrecy

2. Bonus Letter, Dividend Letter, Board of Directors

Ans: Board of directors

3. Dividend Warrant, Interest Warrant, Demat

Ans: Demat

4. Secretary, Board of Directors, Dividend, Lucid Language

Ans: Lucid language

F) Complete the sentences.

1. Dividend is recommended by .......................... .

Ans: Board of directors

2. A company capitalises its Reserve Fund for issue of .......................... shares.

Ans: Bonus

3. Payment of dividend must be made within ................... days of its declaration.

Ans: 30

4. Dividend is approved by the .......................... in the Annual General Meeting.

Ans: Shareholders

5. The ......................... has to communicate the decisions of the management to the members by conducting correspondence.

Ans: Secretary

G) Select the correct option from the bracket

|

Group A

|

Group B

|

|

Group A

|

Group B

|

|

a) Return on shares

|

1. .......................

|

|

b) Capitalization of Reserve fund

|

2 .......................

|

|

c) Correspondence

|

3. .......................

|

|

D) ………………

|

4. Payment of Dividend

Electronically

|

Ans:

|

Group A

|

Group B

|

|

Group A

|

Group B

|

|

a) Return on shares

|

1. Dividend

|

|

b) Capitalization of Reserve fund

|

2 Bonus Share

|

|

c) Correspondence

|

3.Wrttern Communication

|

|

D) ECS

|

4. Payment of Dividend

Electronically

|

H) Answer in one sentence.

1. What is dividend warrant ?

Ans: Dividend warrant is an instrument of payment of Dividend issued by the company to its registered shareholders after the declaration of dividend in the Annual General Meeting of the company.

2. What is capitalization of reserve ?

Ans: Capitalization of reserve means converting into accumulated profit / reserve of company into capital by issued of bonus share to its shareholders.

3. What is Dividend ?

Ans: Dividend is the portion or part of the profit of the company which is distributed / paid to the shareholders of the company as a return of their investment.

4. Who recommends the rate of dividend ?

Ans: Board of Directors is recommends the rate of dividend.

5. Which type of shareholders enjoy the benefit of Bonus Shares ?

Ans: Equity shareholders of the company who are holding the share of the company on the record that enjoy the benefit of bonus shares.

6. What is meant by payment of dividend electronically ?

Ans: Payment of dividend electronically means to directly transfer the amount of dividend into the account of shareholders through electronic mode like ECS, NEFT etc.

I) Correct the underlined word/s and rewrite the following sentences.

1. Dividend is recommended by shareholders.

Ans: Dividend is recommended by Board of Directors.

2. The person who purchases shares of the company is called Depositor.

Ans: The person who purchases shares of the company is called Shareholders

3. Bonus shares are issued as a free gift to the preference shareholders.

Ans: Bonus share are issued as a gift to the equity shareholders

4. Payment of dividend must be made within 21 days of its declaration.

Ans: Payment of dividend must be made within 30 days of its declaration.

5. A company must issue the Share Certificate within three months of allotment of shares.

Ans: A company must issue the shares Certificate within two months of the allotment of shares.

J) Arrange in proper order.

1. a) Allotment of shares

b) Application for shares

c) Share certificate

Ans: b) Application of shares

a) Allotment of shares

c) Share certificate

2. a) Member

b) Applicant

c) Bonus shares

Ans: b) Applicant

a) Member

c) Bonus share

Q.2 Explain the following terms/concepts.

1. Capitalization of Reserves

Ans: (1) The process of issuing the bonus shares out of the company's profits or reserves is known as "Capitalisation of Profits or Reserves.

(2) It is a reward to shareholders, distributed in proportion to the number of shares each owns. The process has no impact on a corporation book value.

2. Bonus Shares

Ans:

Bonus shares are issued as gift to equity shareholders. These shares

are issued free of cost to existing equity shareholders. These are issued out of

accumulated profits. Bonus shares are issued in proportion to the shares held. Thus

capital investment of (ordinary) equity shareholder tends to grow on its own. This

benefit is available only to the equity shareholder

3. Dividend Warrant

Ans: (1) A dividend warrant is a kind of document that reflects whether a shareholder is entitled for a dividend or not.

(2) It is an order of payment in which the dividend is paid. A company uses the dividend warrant to pay the dividend in the form of cashback.

Q.3 Answer in brief.

(1) Which precautions are to be taken by the Secretary while corresponding with members ?

Ans:

The Company Secretary has to correspond with Members on various occasions. While writing

various letters, the Secretary should give due respect to the Members, provide complete and correct

information.

Thus, writing letters to the Members is a challenging task and it requires skill, knowledge

and techniques.

1. Correct Information : The Secretary should always provide correct, up-to date and

factual information to the Members. Due care should be taken while giving facts and

figures.

2. Lucid Language : The Secretary must use simple words, simple sentences and adopt

convincing style while writing letters to the Members. Technical words, long sentences

should be avoided in the letter. It should be easy to understand.

3. Prompt Response : The Secretary must be prompt in sending replies to the letters

received from the Members. Any questions or queries raised by the members must be

promptly replied by the Secretary. Complaint letters should be promptly attended to

without any delay.

4. Secrecy : The Secretary should not disclose any confidential information of the company

to the Members. The Secretary should tactfully answer some letters without giving any

secret information of the company.

5. Politeness (Courtesy) : A courteous letter shows sympathy, respect and mutual

understanding. Politeness means use of courteous language. A complaint letter should

be replied politely. Rude language should be strictly avoided while corresponding with

Members.

6. Legal matters : The Secretary should compulsorily follow relevant provisions of the

Companies Act, 2013 with latest amendments and other relevant laws while corresponding

with Members. While drafting these letters, if necessary Secretary should consult with

legal advisor on certain matters.

7. Consideration : The writer should give due importance and consideration to the reader

and consider the problems of the member. While sending negative replies, he should

draft these letters more carefully, so that Members should not be hurt. Secretary should

make the member feel that the management honestly regrets refusal.

8. Image of the Company : The Secretary should try to project good image of the company

in every situation. While drafting the letters, Secretary has to try his best to remove their

doubts, queries and difficulties in a polite and courteous manner.

2) What are the circumstances under which Secretary undertakes correspondence with members ?

Ans:

The following are the various occasions when the Secretary writes the letters to the members

of the company -

- Allotment Letter

- Regret Letter

- Issue of Share Certificate

- Issue of Bonus Shares

- Execution of Right Issue

- Letter for Payment of Dividend

- Dividend Mandate Approval of Transfer of Shares

- Refusal of Transfer of Shares

- Notice and Agenda of General Meeting

- Notice of loss of Share Certificate

- Reply to certain queries raised by the members.

- Letters to legal representatives regarding Transmission of Shares

The following are the few circumstances under which the Secretary enters into correspondence

with the members of the company.

1. Letter for issue of Share Certificate

2. Letter for Payment of Dividend through

a) Dividend Warrant

b) Electronic Payment of Dividend

3. Letter for issue of Bonus Shares

4. Reply letter to the query of the member on low rate of dividend

Q.4 Justify the following statements.

1. The Company Secretary should take certain precautions while corresponding with members.

Ans:

Justification:

The company secretary should take certain precautions while corresponding with members. They are as follows:

(a) Prompt Reply: In any correspondence prompt reply is very important. The company Secretary must give prompt replies to any queries of the members.

(b) Correct Information: The letter acts as a representative of the organization. Thus, the secretary should always provide all the correct information in a concise or compact manner.

(c) Courtesy: The letter to the members should be polite. A courteous letter shows empathy, respect, and mutual understanding.

(d) Lucid Language: While corresponding with members, the secretary must use simple and lucid language. It should be easy to understand.

(e) Accuracy: In correspondence with members "accuracy" or perfectness is very much important. The Secretary must provide accurate information.

Thus, the company secretary should take certain precautions while corresponding with members.

2. There are certain circumstances when a Secretary has to correspond with members.

Ans:

Justification:

There are circumstances under which a secretary has to enter into correspondence with members. They are as follows:

(a) Letter for the issue of share certificate

(b) Letter for Payment of Dividend through:

• Dividend warrant

• Electronic Payment of Dividend Bonus Shares.

(c) Letter for Issue of Bonus Shares

(d) Reply letter to the query of the member on low rate of dividend.

Thus, there are certain circumstances when a secretary has to correspond with members.

Q.5 Attempt the following.

1. Write a letter to the shareholder regarding issue of Bonus Shares.

2. Write a letter to the member for the issue of Share Certificate.

3. Write a letter to the member for the payment of dividend through Dividend Warrant.

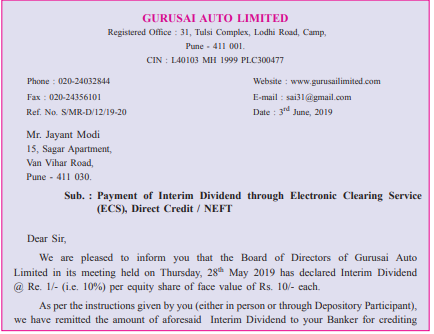

4. Write a letter to the member for the payment of Interim dividend electronically.

5. Draft a reply letter resolving the query of the member on low rate of dividend.

.png)

.png)

0 Comments