Chapter - 8

Correspondence with Depositors

Chapter : 1 Introduction to Corporate Finance

Chapter: 2 Source of Corporate Finance

Chapter: 3 Issue of Shares

Chapter: 4 Issue of Debentures

Chapter: 5 Deposits

Chapter: 6 Correspondence with Members

Chapter: 7 Correspondence with Debenture holders

Chapter: 8 Correspondence with Depositors

Chapter : 9 Depository and Interests

Chapter : 10 Dividend and Interest

Chapter: 11 Financial Markets

Chapter: 12 Stock Exchange

__________________________________________________________________________________

Q.1 A) Select the correct answer from the options given below and rewrite the statements.

1. Depositors are .......................... of a company.

a) Members

b) Creditors

c) Debtors

Ans: Creditors

2. Depositors provide .......................... Capital to the company.

a) Short Term

b) Long Term

c) Medium term

Ans: Short term

3. A Company cannot accept deposit for more than .......................... months.

a) 24

b) 36

c) 45

Ans: 36

4. A company cannot accept deposit for less than .......................... months.

a) 6

b) 3

c) 5

Ans: 6

5. Deposits are .......................... loans of the company.

a) fixed

b) short term

c) long term

Ans: short term

6. Public Deposits are accepted to meet the requirement of .......................... Capital.

a) fixed

b) working

c) owned

Ans: Working

7. .......................... has the power to invite deposits from Public.

a) Shareholders

b) Auditors

c) Board of Directors

Ans: Board of directors

8. Rate of interest on deposits is .......................... .

a) fixed

b) fluctuating

c) moderate

Ans: Fixed

9. The return or income for the investment of money on deposits is called ...........................

a) Dividend

b) Interest

c) Discount

Ans: Interest

Q.1 B) Match the pairs.

|

Group A |

Group B |

|

a) Depositors |

1) Fixed |

|

b) Rate of Interest on Deposits |

2) Evidence of ownership |

|

c) Deposit Receipt |

3) Debtors |

|

4) Creditors |

|

|

5) Evidence of deposit |

|

|

6) Fluctuating |

Ans:

|

Group A |

Group B |

|

a) Depositors |

4) Creditors |

|

b) Rate of Interest on Deposits |

1) Fixed |

|

c) Deposit Receipt |

5) Evidence of deposit |

C) Write a word or a term or a phrase which can substitute each of the following statements.

1. Return on investment on deposit.

2. Instrument for payment of interest on deposit.

Ans: Interest Warrant

3. An acknowledgement of the fixed deposit accepted by a company.

Ans: Fixed Deposit Receipts

4. Return of deposits on maturity date.

Ans: Repayment of Deposits

5. Maximum period of deposits.

Ans: 36 months

D) State whether the following statements are true or false.

1. Fixed deposit is a short term source of finance for the company.

Ans: True

2. Fixed Deposit holder is creditor of the company.

Ans: True

3. Deposits are invited by the company without issuing statutory advertisement.

Ans: False

4. Fixed Deposit holders are entitled to receive dividend.

Ans: False

5. A Private Company cannot accept the deposits from the general public.

Ans: True

6. Depositors are given voting rights.

Ans: False

E) Find the odd one.

1. Dividend, Depositor, Deposit Receipt

Ans: Dividend

2. Trust Deed, Depository, Deposit Receipt

Ans: Depository

F) Complete the sentences.

1. Depositors are the .......................... of the company.

Ans: Creditors

2. The .......................... must be cautious and careful while writing letters to the depositors.

Ans: Secretary

3. Deposit is a .......................... term source of finance of the company.

Ans: short

4. A company can accept deposits for the minimum period of .......................... months.

Ans: 6

5. Depositors are entitled to receive .......................... at fixed rate.

Ans: Interest

G) Select the correct option from the bracket.

|

Group A |

Group B |

|

a) Depositor |

1) --------------- |

|

b) Return on Deposits |

2) -------------- |

|

c) ------------ |

3) Maximum Period of Deposits |

|

d) Minimum Period of Deposits |

4) -------------- |

|

Group A |

Group B |

|

a) Depositor |

1) Creditor of the company |

|

b) Return on Deposits |

2) Interest |

|

c) 36 months, |

3) Maximum Period of Deposits |

|

d) Minimum Period of Deposits |

4) 6 months |

H) Answer in one sentence.

1. Who is depositor ?

Ans: Depositors are the creditors of the company who get interest on his deposits regularly at a fixed rate.

2. What is the return on deposit ?

Ans: Depositors get interest as a return on their investment of money in deposits.

3. What is Interest Warrant ?

Ans: It is a cheque given by a company or an organization in payment of interest on deposit , it is called interest warrant

4. What is renewal of deposit ?

Ans: A process whereby the deposit holder continues with the deposit for an additional time period after the completion of the initial time period of investment (deposit) is called as ‘Renewal of Deposit’.

5. Which document is enclosed along with the Renewal Letter ?

Ans: Fixed deposit receipt is enclosed along with the Renewal Letter.

6. When will the company return the deposit ?

Ans: On maturity of deposit the company return the deposit.

7. What is minimum and maximum period of deposit ?

Ans: The minimum period of deposit is 6 months and the maximum period is 36 months.

I) Correct the underlined words and rewrite the following sentences.

1. Depositors are owners of the company.

Ans: Creditors

2. Deposits are the internal source of financing.

Ans: External

3. Deposit is a long term source of capital.

Ans: Shorts

4. Depositors are entitled to receive dividend.

Ans: Interest

J. Arrange in proper order.

1. a. Renewal of Deposit

b. Acceptance of Deposits

c. Deposit Receipt

Ans: b. Acceptance of Deposits, c. Deposit Receipt, a. Renewal of Deposit

2. a. Payment of Interest

b. Deposit Receipt

c. Acceptance of Deposits

Ans: 2. c. Acceptance of Deposits, b. Deposit Receipt, a. Payment of Interest

Q.2 Explain the following terms/concepts.

1. Depositor

Ans: a) Depositors are the creditors of the company.

b) Depositors get interest on his deposits regularly at fixed rate.

c) They provide short term funds to the company to meet their working capital requirement.

2. Deposit

Ans: a) Deposit is a short term source of finance of the company and it is used in order to satisfy short term working capital needs of the company.

b) Company cannot accept deposits for a period less than 6 months or more than 36 months.

c) The company is liable to pay regular interest on the deposits at a fixed rate along with the principal amount on maturity.

3. Interest on Deposit

Ans: a) A fixed rate of interest is agreed upon and is paid on maturity in case of deposits.

b) Payment of interest is a fixed liability of the company. The company pays interest through Interest Warrant or Electronically.

c) It must be paid by company irrespective of the fact, whether the company makes profit or not.

4. Deposit Receipt

Ans: a) The Deposit Receipt which is proof of receipt of deposit is sent to the depositor along with this letter within 21 days from the date of acceptance of deposits.

b) Deposit receipt gives detailed information regarding the deposits i.e. Amount of deposit, Date of deposit, Period of deposit, Rate of Interest, Maturity date etc.

5. Renewal of Deposit

Ans: a) A process whereby the deposit holder continues with the deposit for an additional time period after the completion of the initial time period of investment (deposit) is called as ‘Renewal of Deposit’.

b) The additional period can be similar or different from the original time period.

6. Repayment of Deposit

Ans: a) On maturity of tenure of deposits, it is binding on the company to repay the deposit.

b) Default in repayment of deposit results in levy of penalty.

c) The letter for repayment of deposit is to be sent to the depositor, when the deposit is to be redeemed.

Q.3 Answer in brief.

1. What precautions are to be borne in mind by the Secretary, while corresponding with Depositors.

Ans:

The following precautions or points to be kept in mind by the Secretary while corresponding with depositors :

1. Legal Provisions : The Secretary should ensure that provisions relating to invitation, acceptance, renewal and repayment of deposits are duly complied with by the company, while corresponding with depositors. Secretary should observe the legal provisions.

2. Courtesy : Polite replies are essential while writing letters to the depositors. Rude words should be strictly avoided.

3. Prompt Response : The Secretary should give prompt replies to the queries and complaints of the depositors without any delay.

4. Accuracy : Letter written to the depositors should be accurate and precise. Factual and correct information should be provided to them.

5. Image and Goodwill : While writing letters, the Secretary has to maintain the goodwill of the company.

6. You Attitude : Letter should be written from depositors point of view, after taking into consideration the requirements of the depositors.

7. Conciseness : The letters must be concise i.e. short, brief and to the point. Un-necesssary and irrelevant information should be avoided.

8. Maximum Secrecy : It is necessary to maintain maximum secrecy as regards secretarial correspondence with depositors.

2. What are the circumstances under which the Secretary makes correspondence with depositors.

Ans: The Secretary has to communicate various decisions of the Board of Directors to the depositors. The following are the few circumstances when the Secretary enters into correspondence with the Depositors :

1. Thanking depositors for depositing amount and showing faith in the company.

2. Intimation about payment of interest through - a) Interest Warrant b) Electronic payment of Interest

3. Letter informing about renewal of deposits.

4. Informing depositors about repayment of deposit on maturity.

Q.4 Justify the following statements.

1. The Company Secretary should take certain precautions while corresponding with depositors.

Ans: The following precautions are to be taken by the Secretary while corresponding with Debenture holder.

1) Legal Provisions: The Secretary should ensure that provisions relating to invitation, acceptance, renewal and repayment of deposits are duly complied with by the company, while corresponding with depositors. The Secretary should observe the legal provisions.

2) Courtesy: Polite replies are essential while writing letters to the depositors. Rude words should be strictly avoided.

3) Prompt Response: The Secretary should give prompt replies to the queries and complaints of the depositors without any delay.

4) Accuracy: The letter written to the depositors should be accurate and precise. Factual and correct information should be provided to them.

2. There are certain circumstances when a secretary has to correspond with Depositors.

Ans: The following are the few circumstances under which the Secretary enters into correspondence

with the depositors.

Thanking depositors for depositing the amount and showing faith in the company.

Intimation about payment of interest through –

a) Interest Warrant

b) Electronic payment of InterestLetter informing about renewal of deposits.

Informing depositors about repayment of deposit on maturity.

Q.5 Attempt the following.

1. Draft a letter of thanks to the depositor of a company.

Ans:

2. Draft a letter to depositor informing him about payment of interest through Interest Warrant.

Ans:

3. Write a letter to depositor regarding renewal of his deposit.

Ans:

4. Draft a letter to depositor regarding repayment of his deposit.

Ans:

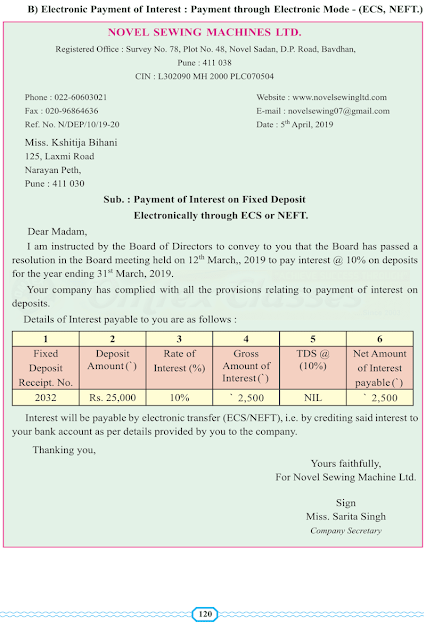

5. Draft a letter to depositor informing him about payment of interest electronically.

Ans:

| Economics |

1. | Choose the Correct Option | 5 Marks | |

2 | Complete the Correction | 5 Marks | |

3 | Give Economic Term | 5 Marks | |

4 | Find the Odd Word | 5 Marks | |

5 | Complete the following Statements | 5 Marks | |

6 | Assertion and Reasoning Questions | 5 Marks | |

7 | Identify and Explain the Concepts | 6 Marks | |

8 | Distinguish Between | 6 Marks | |

9 | Answer in Brief | 12 Marks | |

10 | State with Reasons, Do you Agree/ Disagree | 12 Marks | |

11 | Table, Diagram, Passage Based Questions | 8 Marks | |

12 | Answer in Detail | 16 Marks |

.png)

0 Comments