Maharashtra HSC Board :

Economics (49)

(Q.P. July 2024 with Solution)

Note : (1) All questions are compulsory.

(2) Draw neat tables/diagrams wherever necessary

(3) Figures to the right indicate full marks.

(4) Write answers to all main questions on new pages.

| Economics |

1. | Choose the Correct Option | 5 Marks | |

2 | Complete the Correction | 5 Marks | |

3 | Give Economic Term | 5 Marks | |

4 | Find the Odd Word | 5 Marks | |

5 | Complete the following Statements | 5 Marks | |

6 | Assertion and Reasoning Questions | 5 Marks | |

7 | Identify and Explain the Concepts | 6 Marks | |

8 | Distinguish Between | 6 Marks | |

9 | Answer in Brief | 12 Marks | |

10 | State with Reasons, Do you Agree/ Disagree | 12 Marks | |

11 | Table, Diagram, Passage Based Questions | 8 Marks | |

12 | Answer in Detail | 16 Marks |

Click Here to Download Questions Papers

Q. 1. (A) Choose the correct option: 5

(i) Method adopted in microeconomic analysis.

(a) Lumping method

(b) Aggregative method

(c) Slicing method

(d) Inclusive method

Options:

(1) a, b, c and d

(2) b, c and d

(3) only c

(4) only a

(ii) National income is a/an ________ concept.

(a) stock

(b) final

(c) intermediate

(d) flow

Options:

(1) a and b

(2) only d

(3) b and c

(4) a, b and c

(iii) The source of India's petroleum import.

(a) Kuwait

(b) Saudi Arabia

(c) China

(d) Singapore

Options:

(1) a and b

(2) c and d

(3) a, b and c

(4) b, c and d

(iv) Obligatory functions of the government include.

(a) Provision of employment.

(b) Maintaining internal law and order.

(c) Welfare measures.

(d) Exporting goods and services.

Options:

(1) a and b

(2) c and d

(3) a, b and c

(4) only b

(v) Commercial banks act as intermediaries in the financial system to

(a) make profits

(b) accelerate the country's economic growth

(c) mobilise the saving and allocating them to various sectors of the economy

(d) control the credit

Options:

(1) only a

(2) a and b

(3) b and c

(4) a, b, c and d

(B) Complete the correlations:

(i) Money market: Short-term funds:: ________ :Long-term funds.

Ans: Capital Market

(ii) Table chair: Form utility: Information about Computer: ________

Ans: Knowledge utility

(iii) ☐: Cloth:: Indirect demand: Labour.

Ans: Direct Demand

(iv) Theoretical difficulty: Transfer payments:: _______ : Valuation of inventories

Ans: Practical difficulties

(v) Government expenditure > Government receipt: Deficit budget:: Government expenditure = Government receipt: ________.

Ans: Balanced Budget

(C) Find the odd word out: 5

(i) Necessary goods: Food grains, medicines, car, books.

Ans: Car

(ii) Types of index numbers: Weighted index number. price index number, quantity index number, value index number.

Ans: Weighted index number

(iii) Infrastructural facility: Transport, communication. water supply, subsidies.

Ans: subsidies

(iv) Types of bank accounts: Savings A/c, D-mat A/c. Recurring Deposit A/c, Current A/c.

Ans: D-mat A/c

(v) Theory of factor pricing: Profit, interest. unemployment allowance, rent.

Ans: unemployment allowance

(D) Complete the following statements: 5

(1) MU of the commodity becomes negative when TU of a commodity is _________

(a) rising

(b) constant

(c) falling

(d) zero

(ii) Symbolically, the functional relationship between demand and price can be expressed as _________

(a) Dx=f(Px)

(b) Dx=f(Pz)

(c) Dx=f(Y)

(d) Dx=f(Tx)

(iii) Export trends of India's foreign trade include _________

(a) Petroleum

(b) Engineering goods

(c) Gold

(d) Fertilizers

(iv) Demand curve is parallel to 'Y'-axis in the case of _________

(a) Perfectly elastic demand

(b) Perfectly inelastic demand

(c) Relatively elastic demand

(d) Relatively inelastic demand

(v) Net addition made to the total revenue by selling an extra unit of a commodity is _________

(a) Total revenue

(b) Average revenue

(c) Marginal cost

(d) Marginal revenue

Q. 2. (A) Identify and explain the following concepts: (any three) 6

(i) When the price of apples falls by 10%, Vinay increases his demand for apples by 10%.

(1) Identified concept : Unitary elastic demand.

(2) Explanation of concept : When the proportionate change in the price of a commodity brings about exactly equal proportionate change in its quantity demanded, the demand is said to be unitary elastic.

(ii) Ramakant paid an income tax of 80,000 during the financial year 2021-2022.

(1) Identified concept : Direct tax.

(2) Explanation of concept : A tax which is levied on the income or property of an individual and so in which the impact and incidence of tax is on same head is called direct tax.

(iii) Madhuri deposited a lump sum amount of₹ 1,00,000 in the bank for the period of five years.

(1) Identified concept : Fixed deposit.

(2) Explanation of concept : A fixed deposit is a type of deposit in which the saver deposits a certain amount in the form of deposit in a commercial bank for a fixed period of time and he can withdraw the amount from the deposit after a specified period

(iv) Sunita receives monthly pension of 30,000 from the state government.

(1) Identified concept : Transfer income.

(2) Explanation of concept : If the expenditure incurred by another person/organisation is received by an individual in the form of income without any form of productive work, then such income is called ‘transfer income’.

(v) India purchased petroleum from Iran.

(1) Identified concept : Import trade.

(2) Explanation of concept : Purchase of goods and services by one country from another country is called import trade.

(B) Distinguish between: (any three)

(i) Desire and Demand

|

Desire |

Demand |

|

Desire is a mere wish for something. |

Demand is a desire backed by ability and willingness

to purchase. |

|

Desire has no limits. |

Demand is limited by ability and willingness to pay. |

|

Desire is not related to price. |

Demand is related to time and price. |

|

Desire of a beggar to own a car. |

Demand for a BMW car by Ratan Tata. |

(ii) Internal trade and International trade

|

|

Internal Trade |

International

Trade |

|

1. Meaning |

The sale and

purchase of goods and Services within the geographical boundaries of a nation

is called Internal Trade |

The sale and

purchase of goods and Services outside the geographical boundaries of a

nation is called International Trade |

|

2. Use of

Currency |

Domestic

currency is used for buying and selling goods and services in internal trade. |

Foreign currency

is used for buying and selling goods and services in international trade. |

(iii) Price index number and Quantity index number

Price index number | Quantity index number |

It estimates the relative changes in the prices of goods and services in any two different time periods. | It estimates the relative changes in the quantities or volume of goods sold, consume or produce over a period of time. |

It is obtained by taking the ratio of price level in the current year to the base year. | It is obtained by taking the ratio of quantity in the current year to the base year. |

Formula : Price Index Number P01 = Sum P1 / Sum P0 x 100 | Formula: Quantity Index Number P01 = Sum q1 / Sum q0 x 100 |

(iv) Money market and Capital market

|

|

Money

Market |

Capital

Market |

|

1. Meaning |

A type of

financial market in which short-term

finance is provided is called the money

market |

A type of

financial market in which the medium-term and long-term finance is provided is

called the capital market. |

|

2. Constituents |

The Reserve Bank of India, commercial banks, co-operative banks, development financial institutions, Discount and Finance House of India, indigenous bankers, money lenders, unregulated non-bank financial intermediaries, etc. are the constituents of money market in India. |

Government

securities market, industrial securities

market, development financial institutions,

financial intermediaries, etc. are the

constituents of capital market in India. |

(v) Oligopoly and Monopoly.

Monopoly | Oligopoly |

It is a market situation in which there is a single seller and many buyers. | It is a form of market in which there are few sellers selling either homogeneous or differentiated products. |

In monopoly market, various entry barriers are imposed on the entry of firms. | In oligopoly market, there is free entry and exit for firms. |

No selling cost is incurred by monopolist under monopoly market. | Heavy selling cost is incurred by sellers under oligopoly market. |

Q. 3. Answer the following: (any three) 12

(1) Explain any four features of macroeconomics.

1) Study of aggregates : Macroeconomics deals with the study of a nation’s economy as a whole. It is the study of very large, economy-wide aggregates such as national output or national income, total employment, aggregate demand, aggregate supply, total investment, total consumption, general price level, etc.

(2) Known as Income Theory : Macroeconomics is also known as theory of Income and Employment or Income Analysis. Macroeconomics explains the determination of the level of national income and employment and what causes fluctuations in them. Further it explains the growth of national income over a long period of time and social accounting.

(3) Use of lumping method : Macroeconomics deals with the behaviour of aggregates, i.e. total values of economic variables related to whole economy. It uses method of lumping to deal with macro variables such as aggregate demand, aggregate supply, national output, etc.

(4) Policy-oriented : Macroeconomics, according to Keynes, is a policy-oriented science. Macroeconomic analysis helps in formulating suitable economic policies to promote economic growth, to generate employment, to control inflation, to pull the economy out of depression, etc.

(ii) Explain the types of demand.

The types of demand are as follows :

(1) Direct Demand : Commodities and services satisfying the human wants directly are said to have direct demand. Direct demand is also called conventional demand.

For example, demand for clothes.

(2) Indirect Demand : Commodities and services satisfying human wants indirectly are said to have indirect demand. Indirect demand is also called derived demand.

For example, demand for the factors of production.

(3) Joint Demand : Two or more commodities that are demanded together to satisfy a single want are said to have joint demand. Complementary commodities have joint demand. For example, demand for needle and thread.

(4) Composite Demand : Commodities that are used to satisfy several wants are said to have composite demand. For example, demand for electricity

(iii) Explain any four determinants of supply.

The determinants of supply are as follows :

(1) Price : Price is the most important factor influencing the supply of a commodity. Price and supply are directly related to each other, i.e. more is supplied at higher price and less is supplied at a lower price.

(2) State of technology : Technological improvements reduce the cost of production, which lead to an increase in production and supply. On the other hand, traditional and outdated technology reduces the supply

(3) Cost of production : Cost of production and supply have inverse relation. For example, if the price of factors of production increases, the cost of production also increases. This in turn decreases the profit margin of a supplier and this in turn decreases the supply. On the other hand, fall in the cost of production increases the supply.

(4) Government policies : Government policies on taxation, subsidies, industrial policies, etc. influences the production process as well as supply. Inadequate infrastructural facilities decrease the supply and vice versa

(iv) Explain the classification of public expenditure.

The classification of public expenditure is as follows :

(1) Revenue expenditure : The expenditure which is incurred by the government for carrying out day-to-day functions of the government departments and various administrative services is called revenue expenditure. It is incurred regularly by the government. For example, administration costs of the government, payment of salaries, allowances and pensions of government employees, costs paid for providing medical and public health services, etc.

(2) Capital expenditure : The expenditure which is incurred by the government for boosting the economic growth and development of a country is called capital expenditure. For example, huge investments in different development projects, loans granted to the state governments and government companies, repayment of government loans, etc.

(3) Developmental expenditure : The expenditure of government which yields direct productive impact on the country is called developmental expenditure. Developmental expenditure results in generation of employment, increase in production, price stability, etc. For example, expenditure on health, education, industrial development, social welfare, Research and Development (R & D), etc.

(4) Non-developmental expenditure : The expenditure of government which does not yield any direct productive impact on the country is called non-developmental expenditure. For example, administration costs, war expenditure, etc.

(v) Explain any four limitations of index number.

The limitations of index number are as follows :

(1) Based on samples : Index numbers are generally based on samples. We cannot include all the items in the construction of the index numbers. Hence, index numbers suffer from sampling errors.

(2) Bias in the data : Index numbers are constructed on the basis of various types of data which may be incomplete. There may be bias in the data collected. This is bound to affect the results of the index numbers adversely.

(3) Misuse of index numbers : Index numbers can be misused. They compare a situation in the current year with a situation in the base year. Hence, a person may choose a base year which will be suitable for his purpose. For example, while studying the trends in employment level, if a year of drought or recession is selected as a base year and the level of employment in the current year is checked with reference to employment level in the base year, we may get the misleading results.

(4) Defects in formulae : There is no perfect formula for the construction of an index number. It is only an average and so it has all the limitations of an average

Q. 4. State with reasons whether you agree or disagree with the following statements: (any three)

(i) Large number of buyers and sellers is the only feature of perfect competition.

I disagree with this statement.

Reasons : The following are some of the features of perfect competition :

(1) Homogeneous product : In perfect competition, every firm produces and sells identical product, i.e. units of a commodity produced by each firm are uniform in respect to their size, shape, colour, quality, etc. Therefore, the commodities sold in perfect market are perfect substitutes to one another.

(2) Free entry and free exit : In perfect competition, any firm can freely enter or can exit market without any restrictions. If three is a hope of profit, a new firm can easily enter the market. Similarly, if there is possibilities of losses, the existing firm can freely exit the market.

(3) Single price : In perfect competition, all units of commodity are sold by different sellers have uniform price and it is determined by the equilibrium of the market demand and market supply.

Perfect knowledge of market, perfect mobility of factors of production, absence of transport cost, no government intervention are some other features of perfect competition. Thus, large number of buyers and sellers is not the only feature of perfect competition

(ii) In India the role of money market is very important.

I agree with this statement.

Reasons :

(1) Meeting the short-term requirements of the borrower : Due to the money market, the short-term financial needs of the borrower are met at realistic interest rates.

(2) Liquidity management : Money market facilitates better management of liquidity and money in the economy by the monetary authorities. As a result, the country enjoys economic stability and economic development.

(3) Portfolio management : Money market deals with different types of financial instruments that are designed to suit the risk and return preferences of investors.

This enables the investors to manage portfolios to minimise the risks and to maximise the returns. Acting as an equilibrating mechanisms, meeting the financial requirements of the government, helping government in the implementation of monetary policy, economising the use of cash, promoting growth of commerce, industry and trade, etc. are some of the other important roles played by money market in India. Thus, In India the role of money market is very important.

(iii) Theory of welfare economics is studied in micro- economics.

I agree with this statement.

Reasons :

(1) Efficiency in production : Efficiency in production means to produce maximum possible amount of goods from the given amount of resources. Microeconomics analyses how efficiency in production can be obtained.

(2) Efficiency in consumption : Efficiency in consumption means distribution of produced goods and services among the people for consumption in such a way as to maximize the total satisfaction of society. Microeconomics analyses how efficiency in consumption can be obtained.

(3) Overall economic efficiency : Overall economic efficiency means producing those goods which are most desired by people in society. Microeconomics analyses how overall economic efficiency can be obtained.

Thus, the theory of welfare economics is studied in microeconomics.

(iv) Supply curve slopes upward from left to right.

I agree with this statement.

Reasons :

(1) According to the Law of Supply propounded by Dr. Alfred Marshall, “Other things being constant, the higher the price of a commodity, greater is the quantity supplied and lower the price of a commodity, smaller is the quantity supplied.”

(2) This statement can be explained with the help of the following diagram :

(3) From the diagram it can be seen that as price rises from OP to OP1 supply rises from OQ to OQ1. Similarly, as price falls from OP to OP2 supply falls from OQ to OQ2. Supply curve, i.e. SS indicates the direct relationship between the price and the quantity supplied of a commodity.

Therefore, Supply curve slopes upward from left to right.

(v) Index number can be constructed without the base year.

I disagree with this statement.

Reasons :

(1) Index numbers measures the changes in an economic variable in present times with reference to the year in the past. This year in the past is known as base year.

(2) For the calculation of index numbers, the normal year from the past is selected as the base year. The base year should be normal, i.e. it should be free from natural calamities, warlike conditions, emergencies, etc. Similarly, it should not be too distant in the past.

(3) While preparing index numbers with reference to the base year, it is denoted by the suffix ‘0’. The base year’s index of a selected variable is assumed as 100. The index numbers are measured for the current year on the basis of the past year.

Thus, index numbers cannot be constructed without the base year.

Q. 5. Study the following table, figure, passage and answer the questions given below it: (any two) 8

|

Bill No. 05 Table No. 01 Staff: Amit |

|

Date:

14.08.2018 Time: 10:30

A.M. |

||

|

SR. NO. |

Item Name |

Qty. |

Rate |

Amount (Rs.) |

|

1 |

Register |

02 |

42.00 |

84.00 |

|

2 |

Pen |

10 |

08.00 |

80.00 |

|

3 |

Pencil |

10 |

04.40 |

44.00 |

|

4 |

Rubber/Eraser |

10 |

04.40 |

44.00 |

|

5 |

Scale |

03 |

08.00 |

24.00 |

|

|

|

|

Sub Total SGST 6% CGST 6% |

276.00 6.56 16.56 |

|

|

|

|

Total |

309.12 |

|

GST

No.27AAXPN3502E128 CUST. SIGN AUTHORISED SIGNATORY |

||||

Questions:

(1) Write the short form for goods and services tax. (1)

Ans: The short form for goods and services tax is GST.

(2) What is the percentage of SGST and CGST in the above bill? (1)

Ans: The percentage of SGST and CGST in the given bill is 6% each.

(3) What is the basic price of pen in the above bill? (1)

Ans: The basic price of pen in the given bill is Rs. 8.

(4) What is the GST No. of the seller? (1)

Ans: The GST number of the seller is 27AAXPN3502E128

(ii) Observe the given diagram and answer the following questions:

Questions:

(1) What is represented on 'X'-axis in the above diagram? (1)

Ans: Demand and Supply is represented on ‘X’-axis in the given diagram.

(2) Which price shows equilibrium price of demand and supply? (1)

Ans: Price ₹ 300 shows equilibrium price of demand and supply.

(3) What is represented on 'Y'-axis in the above diagram? (1)

Ans: Price is represented on ‘Y’-axis in the given diagram.

(4) Which point represents the demand and supply equilibrium point in the above diagram?

‘E’ point represents the demand and supply equilibrium point in the given diagram

(iii) On-Demand Economy:

On-demand economy is defined as the economic activity created by digital market places and technology companies to fulfill consumer demand via immediate access to goods and services. The on-demand economy is also sometimes referred as the "access economy" because these companies provide outlets to the wholesalers, retailers and also consumers, the facilities of goods and services.

With consumers behaviour changing to prioritize fast simple and efficient experiences, convenience, speed and simplicity are at the top of the priority list to have their needs met. The ease of filling spare time and picking and choosing one's hours is also appealing to those with skills to meet growing consumer demand. So the on-demand economy is growing at an unparalleled pace.

Many of the popular services people use on a regular basis nowadays are examples of the on-demand economy. Ride-sharing platforms Uber and Ola, as well as grocery delivery services such as Big basket. Dunzo and Reliance JIO Mart are just some examples of services with the on- demand economy.

Questions:

(1) What is on-demand economy sometimes referred as? (1)

Ans: On-demand economy is sometimes referred as Access Economy.

(2) Write any two examples based according to on-demand economy? (1)

Ans: Two examples based according to on-demand economy are (1) Uber (2) Reliance Jio Market.

(3) Write your opinion on the above passage. (2)

Ans: On-demand economy provides easy access to goods and services and therefore nowadays it is used on a large scale by wholesalers, retailers and consumers. It is growing at an unparalleled pace in India.

Click Here to Download Questions Papers

Q. 6. Answer the following questions in detail: (any two) 16

(i) Explain any two methods of measuring national income.

(i) The methods of measuring national income are as follows :

(A) Income method :

Income method of measuring national income is also known as factor cost method. This method approaches national income from the distribution side. This method can be explained with the help of the following points :

(1) According to this method, the income payments received by all citizens of a country, in a given year are added up. The data pertaining to income are obtained from income tax returns, reports, books of accounts as well as estimates from small income.

(2) In this method, the incomes accrued to land, labour, capital and entrepreneur in the forms of rents, wages, interest and profits are all added together. The sum of factor income is treated as Gross National Product. However, in this method, the income received in the form of transfer payments is ignored.

(3) In India, the national income committee of the Central Statistical Organisation uses the income method for adding up the income arising from trade, transport, professional and liberal arts, public administration and domestic services.

(4) GNP according to income method is calculated as follows :

NI = Rent +Wages+ Interest+ Profit +Mixed Income+Net income from abroad.

(B) Expenditure method :

Expenditure method of measuring national income is also known as Outlay Method. According to this method, national income is calculated by summing up all consumption expenditure and investment expenditure made by all individuals, firms as well as the government of a country during a year. Thus, gross national product is found by using the following formula :

NI = C +I+G+ (X – M)+(R – P).

The expenditure method can be explained with the help of the following points :

(1) Private Final Consumption Expenditure (C) : Private final consumption expenditure by households may be on non-durable goods such as food which are used immediately, or on durable goods such as car, computer, television set, washing machine, which are generally used for a longer period of time or on services such as transport services, medical services, etc. National income takes into account the private final consumption expenditure.

(2) Gross Domestic Private Investment Expenditure (I) : It refers to expenditure made by private businesses on replacement, renewals and new investments. National income takes into account the gross domestic private investment expenditure.

(3) Government’s Final Consumption and Investment Expenditure (G) : Government’s final consumption expenditure refers to the expenditure incurred by government on various administrative services like law and order, defence, education, etc. Government’s investment expenditure refers to the expenditure incurred by government on creating infrastructural facilities such as construction of roads, railways, bridges, dams, canals, which are used by the business sector for production of goods and services in any economy. National income takes into account the government’s final consumption expenditure and investment expenditure.

(4) Net Foreign Investment/Net Exports (X – M) : It refers to the difference between exports and imports of a country during a period of one year. National income takes into account the value of net exports.

(5) Net receipts (R – P) : It refers to the difference between expenditure incurred by foreigners in the country (R) and expenditures incurred abroad by residents (P). National income takes into account the value of net receipts.

(ii) Explain the law of diminishing marginal utility and write its assumptions.

Law of Diminishing Marginal Utility : The Law of Diminishing Marginal Utility (DMU) can be explained with the help of the following points :

(1) The Law of DMU was first proposed by Mr. Gossen. However, this law was further explained by Dr. Alfred Marshall in his famous book, ‘Principles of Economics’ in 1890.

(2) Statement of Law : According to Dr. Alfred Marshall, “Other things being equal, the additional benefit which a person derives from the increase in the stock of a thing diminishes with every increase in the stock that he already has.”

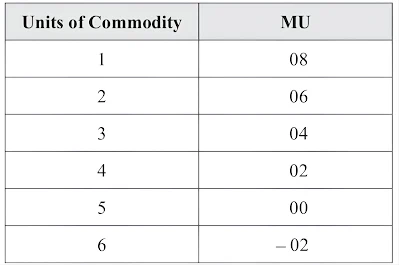

(3) The Law of DMU can be explained with the help of the following schedule :

(4) From the schedule, it can be seen that as the stock of commodity increases from 1 to 6, the marginal utility diminishes from 8 to -02.

(5) The Law of DMU can be explained with the help of the following diagram

(6) In the diagram, the Y-axis represents the marginal utility and the X-axis represents the units of consumption. It can be seen that, the consumer derives the maximum utility from the first unit of the consumption. As consumer keeps consuming the further units, the marginal utility keeps falling.

(7) On the consumption of the 5th unit, the marginal utility becomes zero. Therefore on the consumption of 5th unit, the marginal utility curve touches the X-axis. At this point the total utility is maximum. Therefore, this point is called the point of satiety.

(8) On the consumption of the 6th unit, the marginal utility becomes negative. As its effect, the total utility also starts diminishing. From beginning to end, the marginal utility curve slopes downwards from the left to the right

(B) The assumptions of the Law of Diminishing Marginal Utility :

The assumptions of the Law of Diminishing Marginal Utility (DMU) are as follows :

(1) Rationality : The Law of DMU assumes that a consumer is a rational person and his behaviour is normal. The law assumes that a rational consumer wants to maximise his satisfaction.

(2) Cardinal measurement : The Law of DMU assumes that utility can be measured in numbers. It also assumes that utility derived from each unit of a commodity can be compared.

(3) Homogeneity : The Law of DMU assumes that units of a commodity consumed by a consumer are identical. It means all units of consumption of a commodity are perfectly uniform in respect of size, shape, taste, colour, quality, etc.

(4) Continuity : The Law of DMU assumes that all units of consumption are consumed in quick succession, one after another. Thus law assumes that there is no time gap between the consumption of any two units.

(5) Reasonability : The Law of DMU assumes that the size of unit of commodity of consumption is neither too small nor too big. Thus the law assumes that the size of unit of commodity of consumption is reasonable.

(6) Constancy : The law assumes that income, taste, habits, preferences, likings, etc. of a consumer as well as the price of commodity remains constant.

(7) Divisibility : The law assumes that the commodity consumed by the consumer is divisible.

(8) Single want : The Law of DMU assumes that the commodity is used to satisfy only a single want, i.e. a want of consumption. Thus law assumes that a commodity is not used for any other use except consumption.

(9) Constant marginal utility of money : The law assumes that when the consumer spends his income on a commodity, the utility of remaining money income remains the same as his total income.

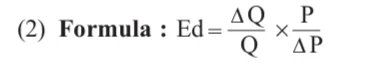

(iii) Explain the concept of price elasticity of demand and explain the types of price elasticity of demand.

(A) Concept of price elasticity of demand :

(1) Meaning : Price elasticity of demand can be defined as the percentage change in the quantity demanded of a commodity in response to a percentage change in the price of a commodity only.

(B) Types of price elasticity of demand :

The types of price elasticity of demand are as follows :

(1) Perfectly/Infinite Elastic Demand :

When a proportionate change in the price of a commodity brings infinite (unlimited) proportionate change in the quantity demanded, the demand is said to be perfectly elastic

Explanation of Diagram :

From the diagram it can be seen that the original price of a commodity is OP and the original demand of a commodity is OQ. When the price of a commodity rises from OP to OP2, the demand of a commodity falls and becomes zero. When the price of a commodity falls from OP to OP1, the demand of a commodity rises up to infinity. In the case of perfectly elastic demand, the demand curve is a horizontal straight line, parallel to X-axis.

The numerical value of perfectly elastic demand is infinity. (Ed = infinity) Perfectly elastic demand is only a theoretical possibility.

(2) Perfectly Inelastic Demand :

When the proportionate change in the price of a commodity brings no (zero) proportionate change in its quantity demanded, the demand is said to be perfectly inelastic

Explanation of Diagram :

From the diagram it can be seen that the original price of a commodity is OP and the original demand of a commodity is OQ. When the price of a commodity rises from OP to OP2 (by 20 per cent) the demand remains constant i.e. OQ. Similarly, when the price of a commodity falls from OP to OP1 (by 20 percent) the demand remains constant. In the case of perfectly inelastic demand, the demand curve is a vertical straight line, parallel to Y-axis.

The numerical value of perfectly inelastic demand is zero. (Ed = 0) Perfectly inelastic demand is also only a theoretical possibility.

(3) Unitary Elastic Demand :

When the proportionate change in the price of a commodity brings about exactly equal proportionate change in its quantity demanded, the demand is said to be unitary elastic.

Explanation of Diagram :

From the diagram it can be seen that the original price of a commodity is OP and the original demand of a commodity is OQ. When the price of a commodity falls from OP to OP1 (by 25 per cent) the demand of a commodity rises from OQ to OQ1 (by 25 per cent). In the case of unitary elastic demand, the demand curve is a rectangular hyperbola.

The numerical value of unitary elastic demand is one. (Ed = 1)

(4) Relatively Elastic Demand :

When the proportionate change in the price of a commodity brings about greater than proportionate change in its quantity demanded, the demand is said to be relatively elastic.

Explanation of Diagram : From the diagram it can be seen that the original price of a commodity is OP and the original demand of a commodity is OQ. When the price of a commodity falls from OP to OP1 (by 25 per cent) the demand of a commodity rises from OQ to OQ1 (by 50 per cent). In the case of relatively elastic demand, the demand curve is a flatter line.

The numerical value of relatively elastic demand is greater than one. (Ed > 1)

(5) Relatively Inelastic Demand :

When the proportionate change in the price of a commodity brings about less than proportionate change in its quantity demanded, the demand is said to be relatively inelastic.

Explanation of Diagram :

From the diagram it can be seen that the original price of a commodity is OP and the original demand of a commodity is OQ. When the price of a commodity falls from OP to OP1 (by 50 per cent) the demand of a commodity rises from OQ to OQ1 (by 10 per cent). In the case of relatively inelastic demand, the demand curve is a steeper line.

The numerical value of relatively inelastic demand is less than one. (Ed < 1)

.png)

.png)

0 Comments